株価も好調。増配です。

目次

VUG 概要

銘柄名:Vanguard Growth ETF

銘柄構成数:262

運用会社:バンガード社

設定日:2004年1月

経費率:年率0.04%

配当利回り0.59%

VUG 株価・配当金・配当利回り

株価は概ね右肩上がりだね。

配当はどうだったの?

ぐりっと

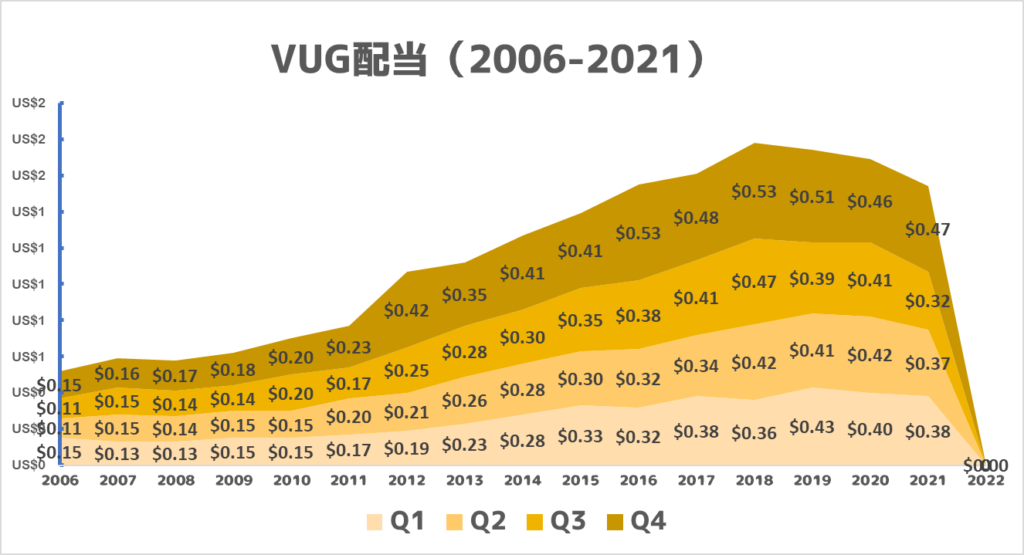

ぐりっと2006年から2022年までをグラフにしました。

2009年・2010年を除くと概ね増配傾向だね。

2010年から2020年にかけて増配が続いている。

これがVUGの魅力だね。

VUG 構成銘柄と構成比率(2022年3月)

2022年3月時点の構成銘柄をすべて掲載しました。

VYMは年1回の入れ替えを行っており、個々の銘柄は個人で確認して参考程度でお願いします。

(投資は最終的に自己責任でお願いします。)

| 1 | Microsoft Corporation | 4.68% |

|---|---|---|

| 2 | UnitedHealth Group Incorporated | 3.89% |

| 3 | Johnson & Johnson | 3.75% |

| 4 | Procter & Gamble Company | 3.29% |

| 5 | JPMorgan Chase & Co. | 3.24% |

| 6 | Visa Inc. Class A | 3.01% |

| 7 | Home Depot, Inc. | 2.88% |

| 8 | Coca-Cola Company | 2.09% |

| 9 | Broadcom Inc. | 2.07% |

| 10 | Costco Wholesale Corporation | 1.98% |

| 11 | PepsiCo, Inc. | 1.96% |

| 12 | Abbott Laboratories | 1.85% |

| 13 | Comcast Corporation Class A | 1.84% |

| 14 | Accenture Plc Class A | 1.73% |

| 15 | Walmart Inc. | 1.66% |

| 16 | Qualcomm Inc | 1.66% |

| 17 | McDonald’s Corporation | 1.58% |

| 18 | NIKE, Inc. Class B | 1.49% |

| 19 | Union Pacific Corporation | 1.38% |

| 20 | Texas Instruments Incorporated | 1.36% |

| 21 | Bristol-Myers Squibb Company | 1.33% |

| 22 | NextEra Energy, Inc. | 1.33% |

| 23 | Lowe’s Companies, Inc. | 1.33% |

| 24 | United Parcel Service, Inc. Class B | 1.32% |

| 25 | Linde plc | 1.31% |

| 26 | Medtronic Plc | 1.22% |

| 27 | Honeywell International Inc. | 1.14% |

| 28 | Oracle Corporation | 1.08% |

| 29 | Starbucks Corporation | 0.93% |

| 30 | Lockheed Martin Corporation | 0.92% |

| 31 | BlackRock, Inc. | 0.92% |

| 32 | Caterpillar Inc. | 0.87% |

| 33 | Target Corporation | 0.84% |

| 34 | S&P Global, Inc. | 0.78% |

| 35 | Stryker Corporation | 0.76% |

| 36 | Chubb Limited | 0.76% |

| 37 | Automatic Data Processing, Inc. | 0.75% |

| 38 | Analog Devices, Inc. | 0.75% |

| 39 | 3M Company | 0.74% |

| 40 | CME Group Inc. Class A | 0.74% |

| 41 | PNC Financial Services Group, Inc. | 0.73% |

| 42 | Truist Financial Corporation | 0.72% |

| 43 | Marsh & McLennan Companies, Inc. | 0.68% |

| 44 | Becton, Dickinson and Company | 0.67% |

| 45 | CSX Corporation | 0.65% |

| 46 | Northrop Grumman Corporation | 0.57% |

| 47 | Colgate-Palmolive Company | 0.57% |

| 48 | Sherwin-Williams Company | 0.56% |

| 49 | Activision Blizzard, Inc. | 0.55% |

| 50 | Illinois Tool Works Inc. | 0.53% |

| 51 | Eaton Corp. Plc | 0.53% |

| 52 | Waste Management, Inc. | 0.48% |

| 53 | Emerson Electric Co. | 0.48% |

| 54 | General Dynamics Corporation | 0.47% |

| 55 | KLA Corporation | 0.46% |

| 56 | Moody’s Corporation | 0.45% |

| 57 | Air Products and Chemicals, Inc. | 0.45% |

| 58 | L3Harris Technologies Inc | 0.44% |

| 59 | Roper Technologies, Inc. | 0.41% |

| 60 | TE Connectivity Ltd. | 0.40% |

| 61 | Sysco Corporation | 0.39% |

| 62 | Kimberly-Clark Corporation | 0.38% |

| 63 | Ecolab Inc. | 0.38% |

| 64 | Archer-Daniels-Midland Company | 0.38% |

| 65 | HP Inc. | 0.38% |

| 66 | Travelers Companies, Inc. | 0.37% |

| 67 | McKesson Corporation | 0.37% |

| 68 | Bank of New York Mellon Corporation | 0.35% |

| 69 | Nucor Corporation | 0.33% |

| 70 | Paychex, Inc. | 0.33% |

| 71 | Aflac Incorporated | 0.33% |

| 72 | Microchip Technology Incorporated | 0.33% |

| 73 | Discover Financial Services | 0.31% |

| 74 | Xcel Energy Inc. | 0.31% |

| 75 | Allstate Corporation | 0.30% |

| 76 | Ameriprise Financial, Inc. | 0.29% |

| 77 | International Flavors & Fragrances Inc. | 0.29% |

| 78 | Cintas Corporation | 0.28% |

| 79 | Fifth Third Bancorp | 0.28% |

| 80 | Arthur J. Gallagher & Co. | 0.28% |

| 81 | T. Rowe Price Group | 0.28% |

| 82 | PPG Industries, Inc. | 0.27% |

| 83 | State Street Corporation | 0.27% |

| 84 | Rockwell Automation, Inc. | 0.27% |

| 85 | Corning Inc | 0.27% |

| 86 | Hershey Company | 0.26% |

| 87 | Fastenal Company | 0.26% |

| 88 | Cummins Inc. | 0.25% |

| 89 | WEC Energy Group Inc | 0.25% |

| 90 | West Pharmaceutical Services, Inc. | 0.25% |

| 91 | Eversource Energy | 0.24% |

| 92 | American Water Works Company, Inc. | 0.24% |

| 93 | Stanley Black & Decker, Inc. | 0.23% |

| 94 | Republic Services, Inc. | 0.22% |

| 95 | Kroger Co. | 0.22% |

| 96 | Vanguard Cash Management Market Liquidity Fund | 0.21% |

| 97 | Church & Dwight Co., Inc. | 0.21% |

| 98 | STERIS Plc | 0.21% |

| 99 | McCormick & Company, Incorporated | 0.21% |

| 100 | Tractor Supply Company | 0.20% |

| 101 | Dover Corporation | 0.20% |

| 102 | Albemarle Corporation | 0.20% |

| 103 | Best Buy Co., Inc. | 0.19% |

| 104 | AmerisourceBergen Corporation | 0.18% |

| 105 | W.W. Grainger, Inc. | 0.18% |

| 106 | Raymond James Financial, Inc. | 0.17% |

| 107 | V.F. Corporation | 0.16% |

| 108 | Pool Corporation | 0.16% |

| 109 | CMS Energy Corporation | 0.16% |

| 110 | Cincinnati Financial Corporation | 0.16% |

| 111 | Clorox Company | 0.16% |

| 112 | Expeditors International of Washington, Inc. | 0.15% |

| 113 | Genuine Parts Company | 0.15% |

| 114 | J.B. Hunt Transport Services, Inc. | 0.15% |

| 115 | Broadridge Financial Solutions, Inc. | 0.15% |

| 116 | Brown & Brown, Inc. | 0.14% |

| 117 | Eastman Chemical Company | 0.14% |

| 118 | Celanese Corporation | 0.13% |

| 119 | FactSet Research Systems Inc. | 0.13% |

| 120 | Cardinal Health, Inc. | 0.13% |

| 121 | J.M. Smucker Company | 0.13% |

| 122 | Avery Dennison Corporation | 0.13% |

| 123 | Alliant Energy Corp | 0.13% |

| 124 | IDEX Corporation | 0.13% |

| 125 | MarketAxess Holdings Inc. | 0.13% |

| 126 | Atmos Energy Corporation | 0.12% |

| 127 | Packaging Corporation of America | 0.12% |

| 128 | Robert Half International Inc. | 0.12% |

| 129 | Hormel Foods Corporation | 0.12% |

| 130 | Jack Henry & Associates, Inc. | 0.11% |

| 131 | C.H. Robinson Worldwide, Inc. | 0.11% |

| 132 | W. R. Berkley Corporation | 0.11% |

| 133 | Cboe Global Markets Inc | 0.11% |

| 134 | Hasbro, Inc. | 0.11% |

| 135 | Carlisle Companies Incorporated | 0.11% |

| 136 | Nordson Corporation | 0.11% |

| 137 | Whirlpool Corporation | 0.11% |

| 138 | Graco Inc. | 0.11% |

| 139 | Reliance Steel & Aluminum Co. | 0.10% |

| 140 | Brown-Forman Corporation Class B | 0.10% |

| 141 | Lincoln National Corporation | 0.10% |

| 142 | Snap-on Incorporated | 0.10% |

| 143 | RPM International Inc. | 0.09% |

| 144 | Regal Rexnord Corporation | 0.09% |

| 145 | Webster Financial Corporation | 0.09% |

| 146 | Essential Utilities, Inc. | 0.09% |

| 147 | Williams-Sonoma, Inc. | 0.09% |

| 148 | Allegion PLC | 0.09% |

| 149 | Service Corporation International | 0.09% |

| 150 | Lithia Motors, Inc. | 0.09% |

| 151 | Toro Company | 0.09% |

| 152 | Assurant, Inc. | 0.09% |

| 153 | Hubbell Incorporated Class B | 0.08% |

| 154 | Pentair plc | 0.08% |

| 155 | Globe Life Inc. | 0.08% |

| 156 | A. O. Smith Corporation | 0.08% |

| 157 | Lennox International Inc. | 0.08% |

| 158 | HEICO Corporation Class A | 0.08% |

| 159 | American Financial Group, Inc. | 0.08% |

| 160 | Churchill Downs Incorporated | 0.07% |

| 161 | UGI Corporation | 0.07% |

| 162 | Commerce Bancshares, Inc. | 0.07% |

| 163 | Aptargroup, Inc. | 0.07% |

| 164 | Cullen/Frost Bankers, Inc. | 0.07% |

| 165 | Royal Gold, Inc. | 0.07% |

| 166 | ITT, Inc. | 0.07% |

| 167 | Reinsurance Group of America, Incorporated | 0.06% |

| 168 | Lincoln Electric Holdings, Inc. | 0.06% |

| 169 | Chemed Corporation | 0.06% |

| 170 | Gentex Corporation | 0.06% |

| 171 | Casey’s General Stores, Inc. | 0.06% |

| 172 | RenaissanceRe Holdings Ltd. | 0.06% |

| 173 | Polaris Inc. | 0.06% |

| 174 | Prosperity Bancshares, Inc.(R) | 0.06% |

| 175 | Donaldson Company, Inc. | 0.06% |

| 176 | Morningstar, Inc. | 0.06% |

| 177 | HEICO Corporation | 0.06% |

| 178 | Littelfuse, Inc. | 0.05% |

| 179 | SEI Investments Company | 0.05% |

| 180 | First Financial Bankshares Inc | 0.05% |

| 181 | ManpowerGroup Inc. | 0.05% |

| 182 | Ingredion Incorporated | 0.05% |

| 183 | Sonoco Products Company | 0.05% |

| 184 | Scotts Miracle-Gro Company Class A | 0.05% |

| 185 | Bank OZK | 0.05% |

| 186 | MDU Resources Group Inc | 0.05% |

| 187 | Ashland Global Holdings, Inc. | 0.05% |

| 188 | Primerica, Inc. | 0.04% |

| 189 | Hanover Insurance Group, Inc. | 0.04% |

| 190 | MSA Safety, Inc. | 0.04% |

| 191 | Thor Industries, Inc. | 0.04% |

| 192 | Perrigo Co. Plc | 0.04% |

| 193 | Evercore Inc Class A | 0.04% |

| 194 | Balchem Corporation | 0.04% |

| 195 | ONE Gas, Inc. | 0.04% |

| 196 | UMB Financial Corporation | 0.04% |

| 197 | Ensign Group, Inc. | 0.04% |

| 198 | Erie Indemnity Company Class A | 0.04% |

| 199 | Axis Capital Holdings Limited | 0.04% |

| 200 | New Jersey Resources Corporation | 0.04% |

| 201 | Independent Bank Corp. | 0.04% |

| 202 | RLI Corp. | 0.03% |

| 203 | Community Bank System, Inc. | 0.03% |

| 204 | Applied Industrial Technologies, Inc. | 0.03% |

| 205 | GATX Corporation | 0.03% |

| 206 | Westlake Corporation | 0.03% |

| 207 | H.B. Fuller Company | 0.03% |

| 208 | Silgan Holdings Inc. | 0.03% |

| 209 | Home BancShares, Inc. | 0.03% |

| 210 | Hillenbrand, Inc. | 0.03% |

| 211 | Sensient Technologies Corporation | 0.03% |

| 212 | American Equity Investment Life Holding Company | 0.03% |

| 213 | Lancaster Colony Corporation | 0.03% |

| 214 | Franklin Electric Co., Inc. | 0.03% |

| 215 | Insperity, Inc. | 0.03% |

| 216 | BOK Financial Corporation | 0.03% |

| 217 | American States Water Company | 0.03% |

| 218 | Atlantic Union Bankshares Corporation | 0.03% |

| 219 | ABM Industries Incorporated | 0.03% |

| 220 | California Water Service Group | 0.03% |

| 221 | Badger Meter, Inc. | 0.03% |

| 222 | WD-40 Company | 0.03% |

| 223 | MGE Energy, Inc. | 0.02% |

| 224 | Quaker Houghton | 0.02% |

| 225 | Trinity Industries, Inc. | 0.02% |

| 226 | J & J Snack Foods Corp. | 0.02% |

| 227 | Chesapeake Utilities Corporation | 0.02% |

| 228 | Nu Skin Enterprises, Inc. Class A | 0.02% |

| 229 | International Bancshares Corporation | 0.02% |

| 230 | Brady Corporation Class A | 0.02% |

| 231 | Stepan Company | 0.02% |

| 232 | John Wiley & Sons, Inc. Class A | 0.02% |

| 233 | Cohen & Steers, Inc. | 0.02% |

| 234 | McGrath RentCorp | 0.02% |

| 235 | Worthington Industries, Inc. | 0.02% |

| 236 | SJW Group | 0.02% |

| 237 | Middlesex Water Company | 0.02% |

| 238 | Horace Mann Educators Corporation | 0.02% |

| 239 | Westamerica Bancorporation | 0.01% |

| 240 | Monro Inc | 0.01% |

| 241 | BancFirst Corporation | 0.01% |

| 242 | Tennant Company | 0.01% |

| 243 | Lindsay Corporation | 0.01% |

| 244 | Andersons, Inc. | 0.01% |

| 245 | Southside Bancshares, Inc. | 0.01% |

| 246 | Stock Yards Bancorp, Inc. | 0.01% |

| 247 | Standex International Corporation | 0.01% |

| 248 | Healthcare Services Group, Inc. | 0.01% |

| 249 | Lakeland Bancorp, Inc. | 0.01% |

| 250 | Dillard’s, Inc. Class A | 0.01% |

| 251 | Matthews International Corporation Class A | 0.01% |

| 252 | Atrion Corporation | 0.01% |

| 253 | Tompkins Financial Corporation | 0.01% |

| 254 | National HealthCare Corporation | 0.01% |

| 255 | Douglas Dynamics, Inc. | 0.01% |

| 256 | Hawkins, Inc. | 0.01% |

| 257 | 1st Source Corporation | 0.01% |

| 258 | Gorman-Rupp Company | 0.01% |

| 259 | Horizon Bancorp, Inc. | 0.01% |

| 260 | Community Trust Bancorp, Inc. | 0.01% |

| 261 | York Water Company | 0.01% |

| 262 | Tootsie Roll Industries, Inc. | 0.01% |

| 263 | Bank of Marin Bancorp | 0.00% |

| 264 | First Financial Corporation | 0.00% |

| 265 | Cass Information Systems, Inc. | 0.00% |

| 266 | VSE Corporation | 0.00% |

| 267 | Utah Medical Products, Inc. | 0.00% |

| 268 | U.S. Dollar | 0.00% |

| 269 | Rollins, Inc. | 0.00% |

VYMより少ないけれど、何銘柄あるの?

267銘柄だよ

構成はどうなっているの?

上位10銘柄に47%

上位20銘柄に60.54%

上位50銘柄に76%。

上位100銘柄に構成比率87%。

偏っているETFだよ

VYMと違って上位10銘柄に偏っていることがハイテクETFの特徴なんだね。

まとめ

・インカムゲイン(配当)は期待できないが、キャピタルゲイン向きのETF

・ハイテク銘柄に期待したい、QQQと類似したETF。

・上位10-20銘柄に偏っているため、上位銘柄には要注意。

雑談(サラリーマン投資家ぐりっと目線)

総資産1000万家計のぐりっとはいくらETFに投資している?

1株は保有しているが、今後も大きく増やす予定なし。

大きく値下がり時、バリュー株に偏りに対抗して購入を検討の余地あり。

投資スタイルに応じてうまく購入していこう。

20代・30代であれば投資妙味があるかも?

関連記事:あわせて読みたい

あわせて読みたい

バンガード・米国高配当株式ETF【VYM】全銘柄を網羅してみた!! 2022年6月のVYMが増配されます。

これを記念してVYMについてまとめてみました。411銘柄を掲載しています。人気の記事です。

あわせて読みたい

バンガード社のETFをまとめてみた【2021年12月22日】 今回のテーマはバンガード社のETFです。 世界で初めてインデックス投資ETFを扱った会社でもあり、投資の世界では知らない人はいないと思います。 そのバンガード社が取…

コメント