今回は連続増配ETF(VIG)を紹介します。

みなさんはVIGについて興味はありませんか?

(2022年Q2の配当が発表されたこともあり、再構成しました)

日本では高配当ETFが人気がありますが、米国では連続増配ETFの方が人気があります。

VIG 概要

銘柄名:Vanguard Dividend Appreciation ETF

銘柄構成数:266

運用会社:バンガード社

設定日:2006年4月21日

経費率:年率0.06%

配当利回り2.00%(2022/6/20)

VIGは米国株100%で構成されているよ

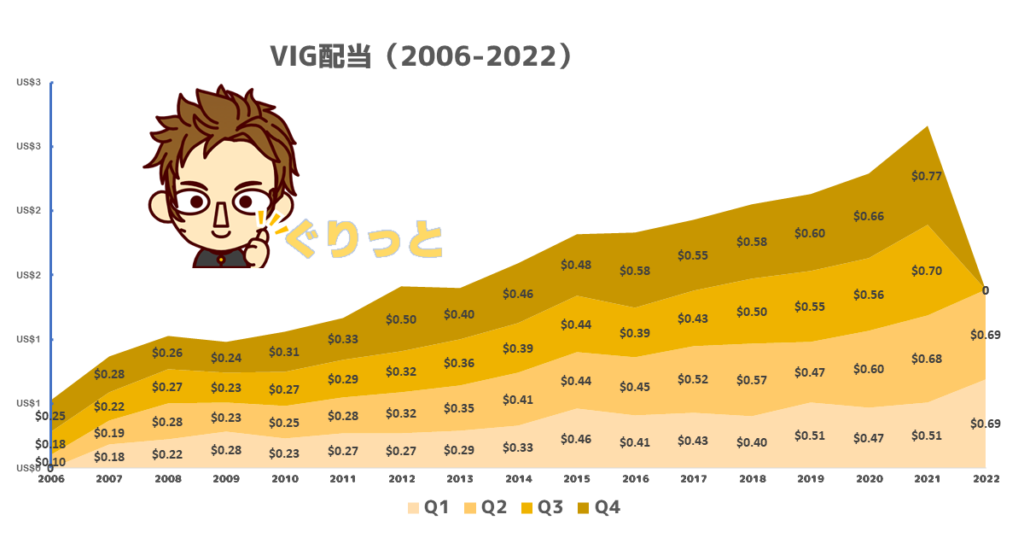

VIG 株価・配当金・配当利回り

コロナ禍においては少し苦戦しているね

ぐりっと

ぐりっと増配銘柄も右肩上がりとはいかないね。

長期的にはインカムゲイン・キャピタルゲインとも狙えるETFだね

ただしインカムゲイン向きではないかもしれないね。

VIG 構成銘柄と構成比率(2022年6月)

2022年6月時点の構成銘柄をすべて掲載しました。

VIGは年1回の入れ替えを行っており、個々の銘柄は個人で確認して参考程度でお願いします。

(投資は最終的に自己責任でお願いします。)

| 1 | Microsoft Corporation | 3.88% |

| 2 | UnitedHealth Group Incorporated | 3.88% |

| 3 | Johnson & Johnson | 3.85% |

| 4 | Procter & Gamble Company | 3.15% |

| 5 | JPMorgan Chase & Co. | 2.86% |

| 6 | Visa Inc. Class A | 2.77% |

| 7 | Home Depot, Inc. | 2.57% |

| 8 | Mastercard Incorporated Class A | 2.55% |

| 9 | Coca-Cola Company | 2.03% |

| 10 | PepsiCo, Inc. | 1.92% |

| 11 | Costco Wholesale Corporation | 1.90% |

| 12 | Broadcom Inc. | 1.85% |

| 13 | Walmart Inc. | 1.76% |

| 14 | Cisco Systems, Inc. | 1.67% |

| 15 | Abbott Laboratories | 1.63% |

| 16 | Accenture Plc Class A | 1.54% |

| 17 | McDonald’s Corporation | 1.51% |

| 18 | Comcast Corporation Class A | 1.47% |

| 19 | Bristol-Myers Squibb Company | 1.35% |

| 20 | Linde plc | 1.29% |

| 21 | NIKE, Inc. Class B | 1.29% |

| 22 | Texas Instruments Incorporated | 1.27% |

| 23 | Qualcomm Incorporated | 1.27% |

| 24 | Union Pacific Corporation | 1.22% |

| 25 | Medtronic Plc | 1.14% |

| 26 | NextEra Energy, Inc. | 1.13% |

| 27 | Lowe’s Companies, Inc. | 1.11% |

| 28 | S&P Global, Inc. | 1.08% |

| 29 | Honeywell International Inc. | 1.08% |

| 30 | United Parcel Service, Inc. Class B | 1.06% |

| 31 | Anthem, Inc. | 0.99% |

| 32 | Intuit Inc. | 0.96% |

| 33 | Oracle Corporation | 0.96% |

| 34 | Caterpillar Inc. | 0.92% |

| 35 | Target Corporation | 0.90% |

| 36 | Lockheed Martin Corporation | 0.86% |

| 37 | Goldman Sachs Group, Inc. | 0.84% |

| 38 | Automatic Data Processing, Inc. | 0.74% |

| 39 | BlackRock, Inc. | 0.72% |

| 40 | Chubb Limited | 0.72% |

| 41 | Starbucks Corporation | 0.71% |

| 42 | Analog Devices, Inc. | 0.67% |

| 43 | Marsh & McLennan Companies, Inc. | 0.66% |

| 44 | Stryker Corporation | 0.66% |

| 45 | CME Group Inc. Class A | 0.64% |

| 46 | CSX Corporation | 0.62% |

| 47 | Becton, Dickinson and Company | 0.57% |

| 48 | PNC Financial Services Group, Inc. | 0.57% |

| 49 | Sherwin-Williams Company | 0.54% |

| 50 | Northrop Grumman Corporation | 0.53% |

| 51 | Colgate-Palmolive Company | 0.53% |

| 52 | Truist Financial Corporation | 0.52% |

| 53 | Aon Plc Class A | 0.51% |

| 54 | Waste Management, Inc. | 0.51% |

| 55 | Activision Blizzard, Inc. | 0.48% |

| 56 | Eaton Corp. Plc | 0.47% |

| 57 | Humana Inc. | 0.46% |

| 58 | Illinois Tool Works Inc. | 0.46% |

| 59 | General Dynamics Corporation | 0.44% |

| 60 | Emerson Electric Co. | 0.44% |

| 61 | Air Products and Chemicals, Inc. | 0.42% |

| 62 | Moody’s Corporation | 0.41% |

| 63 | Archer-Daniels-Midland Company | 0.41% |

| 64 | Roper Technologies, Inc. | 0.40% |

| 65 | KLA Corporation | 0.39% |

| 66 | McKesson Corporation | 0.38% |

| 67 | L3Harris Technologies Inc | 0.37% |

| 68 | Nucor Corporation | 0.36% |

| 69 | Sysco Corporation | 0.35% |

| 70 | Amphenol Corporation Class A | 0.35% |

| 71 | HP Inc. | 0.34% |

| 72 | Ecolab Inc. | 0.34% |

| 73 | Travelers Companies, Inc. | 0.34% |

| 74 | TE Connectivity Ltd. | 0.33% |

| 75 | Paychex, Inc. | 0.33% |

| 76 | Xcel Energy Inc. | 0.32% |

| 77 | Allstate Corporation | 0.29% |

| 78 | Microchip Technology Incorporated | 0.29% |

| 79 | Motorola Solutions, Inc. | 0.29% |

| 80 | Arthur J. Gallagher & Co. | 0.28% |

| 81 | Cintas Corporation | 0.28% |

| 82 | Aflac Incorporated | 0.28% |

| 83 | Discover Financial Services | 0.27% |

| 84 | Hershey Company | 0.27% |

| 85 | Bank of New York Mellon Corp | 0.26% |

| 86 | Fastenal Company | 0.26% |

| 87 | WEC Energy Group Inc | 0.26% |

| 88 | International Flavors & Fragrances Inc. | 0.25% |

| 89 | PPG Industries, Inc. | 0.25% |

| 90 | Eversource Energy | 0.24% |

| 91 | Ameriprise Financial, Inc. | 0.24% |

| 92 | Rockwell Automation, Inc. | 0.24% |

| 93 | Republic Services, Inc. | 0.23% |

| 94 | American Water Works Company, Inc. | 0.23% |

| 95 | Kroger Co. | 0.22% |

| 96 | T. Rowe Price Group | 0.22% |

| 97 | Tyson Foods, Inc. Class A | 0.22% |

| 98 | Cummins Inc. | 0.22% |

| 99 | Corning Inc | 0.22% |

| 100 | Fifth Third Bancorp | 0.21% |

| 101 | DTE Energy Company | 0.21% |

| 102 | McCormick & Company, Incorporated | 0.20% |

| 103 | State Street Corporation | 0.20% |

| 104 | Church & Dwight Co., Inc. | 0.19% |

| 105 | Vanguard Cash Management Market Liquidity Fund | 0.19% |

| 106 | West Pharmaceutical Services, Inc. | 0.19% |

| 107 | Tractor Supply Company | 0.19% |

| 108 | AmerisourceBergen Corporation | 0.18% |

| 109 | Albemarle Corporation | 0.18% |

| 110 | STERIS Plc | 0.18% |

| 111 | W.W. Grainger, Inc. | 0.18% |

| 112 | Best Buy Co., Inc. | 0.16% |

| 113 | CMS Energy Corporation | 0.16% |

| 114 | Stanley Black & Decker, Inc. | 0.16% |

| 115 | Dover Corporation | 0.16% |

| 116 | Genuine Parts Company | 0.15% |

| 117 | Cincinnati Financial Corporation | 0.15% |

| 118 | Raymond James Financial, Inc. | 0.15% |

| 119 | Clorox Company | 0.14% |

| 120 | V.F. Corporation | 0.14% |

| 121 | Broadridge Financial Solutions, Inc. | 0.14% |

| 122 | Expeditors International of Washington, Inc. | 0.14% |

| 123 | Quest Diagnostics Incorporated | 0.13% |

| 124 | Pool Corporation | 0.13% |

| 125 | Celanese Corporation | 0.13% |

| 126 | Packaging Corporation of America | 0.12% |

| 127 | FactSet Research Systems Inc. | 0.12% |

| 128 | Atmos Energy Corporation | 0.12% |

| 129 | Avery Dennison Corporation | 0.12% |

| 130 | J.M. Smucker Company | 0.12% |

| 131 | Hormel Foods Corporation | 0.12% |

| 132 | Alliant Energy Corp | 0.12% |

| 133 | Brown & Brown, Inc. | 0.12% |

| 134 | Xylem Inc. | 0.12% |

| 135 | IDEX Corporation | 0.12% |

| 136 | J.B. Hunt Transport Services, Inc. | 0.12% |

| 137 | Jack Henry & Associates, Inc. | 0.11% |

| 138 | W. R. Berkley Corporation | 0.11% |

| 139 | Eastman Chemical Company | 0.11% |

| 140 | C.H. Robinson Worldwide, Inc. | 0.11% |

| 141 | Carlisle Companies Incorporated | 0.11% |

| 142 | Reliance Steel & Aluminum Co. | 0.10% |

| 143 | Brown-Forman Corporation Class B | 0.10% |

| 144 | Cboe Global Markets Inc | 0.10% |

| 145 | Nordson Corporation | 0.09% |

| 146 | Snap-on Incorporated | 0.09% |

| 147 | Whirlpool Corporation | 0.09% |

| 148 | Robert Half International Inc. | 0.09% |

| 149 | Service Corporation International | 0.09% |

| 150 | RPM International Inc. | 0.09% |

| 151 | Hubbell Incorporated | 0.09% |

| 152 | Graco Inc. | 0.09% |

| 153 | Assurant, Inc. | 0.08% |

| 154 | Essential Utilities, Inc. | 0.08% |

| 155 | Allegion Public Limited Company | 0.08% |

| 156 | Lincoln National Corporation | 0.08% |

| 157 | MarketAxess Holdings Inc. | 0.08% |

| 158 | Williams-Sonoma, Inc. | 0.08% |

| 159 | American Financial Group, Inc. | 0.07% |

| 160 | Globe Life Inc. | 0.07% |

| 161 | HEICO Corporation Class A | 0.07% |

| 162 | Regal Rexnord Corporation | 0.07% |

| 163 | Lithia Motors, Inc. | 0.07% |

| 164 | Royal Gold, Inc. | 0.07% |

| 165 | Toro Company | 0.07% |

| 166 | Texas Pacific Land Corporation | 0.07% |

| 167 | Pentair plc | 0.07% |

| 168 | Lincoln Electric Holdings, Inc. | 0.06% |

| 169 | A. O. Smith Corporation | 0.06% |

| 170 | Commerce Bancshares, Inc. | 0.06% |

| 171 | Chemed Corporation | 0.06% |

| 172 | Aptargroup, Inc. | 0.06% |

| 173 | Cullen/Frost Bankers, Inc. | 0.06% |

| 174 | Casey’s General Stores, Inc. | 0.06% |

| 175 | Reinsurance Group of America, Incorporated | 0.06% |

| 176 | Lennox International Inc. | 0.06% |

| 177 | Churchill Downs Incorporated | 0.06% |

| 178 | Gentex Corporation | 0.06% |

| 179 | RenaissanceRe Holdings Ltd. | 0.05% |

| 180 | National Fuel Gas Company | 0.05% |

| 181 | Sonoco Products Company | 0.05% |

| 182 | Donaldson Company, Inc. | 0.05% |

| 183 | Prosperity Bancshares, Inc.(R) | 0.05% |

| 184 | Morningstar, Inc. | 0.05% |

| 185 | SouthState Corporation | 0.05% |

| 186 | Ashland Global Holdings, Inc. | 0.05% |

| 187 | HEICO Corporation | 0.05% |

| 188 | SEI Investments Company | 0.05% |

| 189 | Ingredion Incorporated | 0.05% |

| 190 | Littelfuse, Inc. | 0.05% |

| 191 | Polaris Inc. | 0.04% |

| 192 | IDACORP, Inc. | 0.04% |

| 193 | MDU Resources Group Inc | 0.04% |

| 194 | Hanover Insurance Group, Inc. | 0.04% |

| 195 | First Financial Bankshares Inc | 0.04% |

| 196 | Primerica, Inc. | 0.04% |

| 197 | ManpowerGroup Inc. | 0.04% |

| 198 | Bank OZK | 0.04% |

| 199 | Perrigo Co. Plc | 0.04% |

| 200 | RLI Corp. | 0.04% |

| 201 | ONE Gas, Inc. | 0.04% |

| 202 | Avient Corporation | 0.04% |

| 203 | Axis Capital Holdings Limited | 0.04% |

| 204 | MSA Safety, Inc. | 0.04% |

| 205 | Thor Industries, Inc. | 0.03% |

| 206 | Scotts Miracle-Gro Company Class A | 0.03% |

| 207 | Ensign Group, Inc. | 0.03% |

| 208 | Westlake Corporation | 0.03% |

| 209 | New Jersey Resources Corporation | 0.03% |

| 210 | Evercore Inc Class A | 0.03% |

| 211 | Applied Industrial Technologies, Inc. | 0.03% |

| 212 | Erie Indemnity Company Class A | 0.03% |

| 213 | Balchem Corporation | 0.03% |

| 214 | UMB Financial Corporation | 0.03% |

| 215 | Assured Guaranty Ltd. | 0.03% |

| 216 | Insperity, Inc. | 0.03% |

| 217 | Ryder System, Inc. | 0.03% |

| 218 | Silgan Holdings Inc. | 0.03% |

| 219 | Cabot Corporation | 0.03% |

| 220 | GATX Corporation | 0.03% |

| 221 | Independent Bank Corp. | 0.03% |

| 222 | Sensient Technologies Corporation | 0.03% |

| 223 | H.B. Fuller Company | 0.03% |

| 224 | Community Bank System, Inc. | 0.03% |

| 225 | Home BancShares, Inc. | 0.03% |

| 226 | ABM Industries Incorporated | 0.03% |

| 227 | American Equity Investment Life Holding Company | 0.03% |

| 228 | Simmons First National Corporation Class A | 0.02% |

| 229 | Lancaster Colony Corporation | 0.02% |

| 230 | Hillenbrand, Inc. | 0.02% |

| 231 | American States Water Company | 0.02% |

| 232 | MGE Energy, Inc. | 0.02% |

| 233 | Franklin Electric Co., Inc. | 0.02% |

| 234 | California Water Service Group | 0.02% |

| 235 | Atlantic Union Bankshares Corporation | 0.02% |

| 236 | WD-40 Company | 0.02% |

| 237 | BOK Financial Corporation | 0.02% |

| 238 | Badger Meter, Inc. | 0.02% |

| 239 | Trinity Industries, Inc. | 0.02% |

| 240 | First Merchants Corporation | 0.02% |

| 241 | J & J Snack Foods Corp. | 0.02% |

| 242 | John Wiley & Sons, Inc. Class A | 0.02% |

| 243 | Chesapeake Utilities Corporation | 0.02% |

| 244 | Quaker Houghton | 0.02% |

| 245 | Brady Corporation Class A | 0.02% |

| 246 | Stepan Company | 0.02% |

| 247 | Nu Skin Enterprises, Inc. Class A | 0.02% |

| 248 | International Bancshares Corporation | 0.02% |

| 249 | McGrath RentCorp | 0.02% |

| 250 | Cohen & Steers, Inc. | 0.02% |

| 251 | Lakeland Financial Corporation | 0.01% |

| 252 | TowneBank | 0.01% |

| 253 | Sandy Spring Bancorp, Inc. | 0.01% |

| 254 | Embecta Corporation | 0.01% |

| 255 | Horace Mann Educators Corporation | 0.01% |

| 256 | SJW Group | 0.01% |

| 257 | Westamerica Bancorporation | 0.01% |

| 258 | Middlesex Water Company | 0.01% |

| 259 | Andersons, Inc. | 0.01% |

| 260 | Worthington Industries, Inc. | 0.01% |

| 261 | BancFirst Corporation | 0.01% |

| 262 | Monro Inc | 0.01% |

| 263 | Lindsay Corporation | 0.01% |

| 264 | Dillard’s, Inc. Class A | 0.01% |

| 265 | Stock Yards Bancorp, Inc. | 0.01% |

| 266 | Southside Bancshares, Inc. | 0.01% |

| 267 | SpartanNash Company | 0.01% |

| 268 | Tennant Company | 0.01% |

| 269 | Standex International Corporation | 0.01% |

| 270 | Apogee Enterprises, Inc. | 0.01% |

| 271 | Matthews International Corporation Class A | 0.01% |

| 272 | Federal Agricultural Mortgage Corporation Class C | 0.01% |

| 273 | Lakeland Bancorp, Inc. | 0.01% |

| 274 | National HealthCare Corporation | 0.01% |

| 275 | Griffon Corporation | 0.01% |

| 276 | Atrion Corporation | 0.01% |

| 277 | Tompkins Financial Corporation | 0.01% |

| 278 | LeMaitre Vascular, Inc. | 0.01% |

| 279 | 1st Source Corporation | 0.01% |

| 280 | Gorman-Rupp Company | 0.01% |

| 281 | Douglas Dynamics, Inc. | 0.01% |

| 282 | Hawkins, Inc. | 0.01% |

| 283 | Horizon Bancorp, Inc. | 0.01% |

| 284 | Aaron’s Company Inc | 0.01% |

| 285 | Tootsie Roll Industries, Inc. | 0.00% |

| 286 | York Water Company | 0.00% |

| 287 | Bank of Marin Bancorp | 0.00% |

| 288 | First Financial Corporation | 0.00% |

| 289 | Cass Information Systems, Inc. | 0.00% |

| 290 | Southern Missouri Bancorp, Inc. | 0.00% |

| 291 | U.S. Dollar | 0.00% |

VIGの比率は半年前と比べるとMicrosoftの比率が4.68から3.88%に下がっているね。上位銘柄も構成銘柄は買わないけれど、少し比率が下がりました。銘柄数も大幅に分散が効いているようだね。

増配銘柄を探すことが面倒な人にはおすすめだね

上位10銘柄で構成比率29.46%、上位20銘柄で45.43%

上位30銘柄で57.08%、上位50銘柄で71.86%、上位100銘柄で88.54%だよ。

上位20銘柄で約半分だね。

この20銘柄を確認しておくと安心だね。

まとめ

・インカムゲイン(配当)、キャピタルゲインの2つとも狙えるETF

・米国では高配当ETF(VYM)より人気がある

・コロナ禍でキャピタルゲインの影響があり、不況には弱いか?

・上位20銘柄に興味があれば、投資選択になりえる。

雑談(サラリーマン投資家ぐりっと目線)

総資産1000万家計のぐりっとはVIGに投資している?

回答:9株(約17万円)保有。円安に伴い株価はマイナス推移だが円換算ではプラス推移している。

投資先がみつからない時は、VIGに投資します。

少しずつ株数を増やしていく予定。

VIGに投資する人は玄人投資家。

いぶし銀のような渋い投資家だと思うよ。

そんな投資家に憧れます。

関連記事:あわせて読みたい

コメント