VYMの2023年Q3が発表されましたので、直近のデータを含めて分析しました。

インカムゲインやキャピタルゲイン、両方を狙う戦略など投資家によって異なるとは思いますが、VYMについて詳細を紹介していきます。

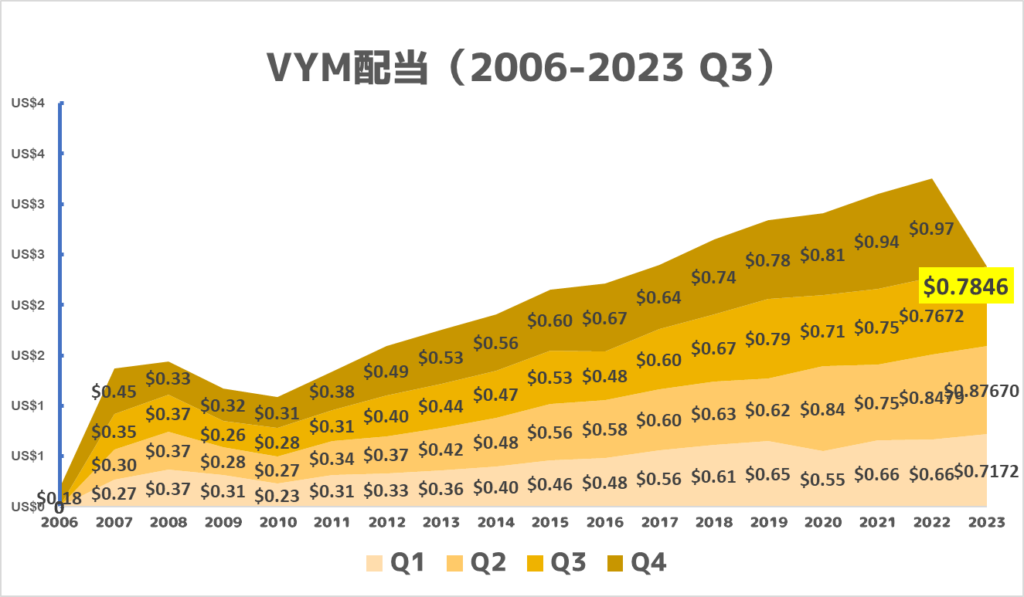

VYM:2023年Q3配当

・2023年Q3配当金:$0.784600

・支払日:2023年9月21日

・前年同期比:6.74%

ぐりっと

ぐりっと2022年Q3は$0.717200、6.74%増配です

増配率 = ((今回の配当 – 前回の配当) / 前回の配当) × 100%

今回の配当は$0.87667、前回の配当は$0.8479

増配率 = (0.784600 – 0.717200) / 0.717200 =0.0674

参考サイト

VYMの投資成績を詳しく知りたい人はバンガード社のホームページを参考にしてください。

ここからは2023年Q3時点のVYMの最新情報です

VYM 基本知識

銘柄名:バンガード・米国高配当株式ETF

銘柄構成数:462

運用会社:バンガード社

管理資産;497億8000万ドル

設定日:2006年11月10日

経費率:年率0.06%

ベンチマーク:FTSEハイディビデンド・イールド・インデックス

VYM 株価・配当金・配当利回り

| 西暦 | Q1 | Q2 | Q3 | Q4 | 合計 | 増配率 |

| 2006 | $0.18 | $0.18 | ||||

| 2007 | $0.27 | $0.30 | $0.35 | $0.45 | $1.36 | 655.6% |

| 2008 | $0.37 | $0.37 | $0.37 | $0.33 | $1.44 | 5.9% |

| 2009 | $0.31 | $0.28 | $0.26 | $0.32 | $1.17 | -18.8% |

| 2010 | $0.23 | $0.27 | $0.28 | $0.31 | $1.09 | -6.8% |

| 2011 | $0.31 | $0.34 | $0.31 | $0.38 | $1.33 | 22.0% |

| 2012 | $0.33 | $0.37 | $0.40 | $0.49 | $1.59 | 19.5% |

| 2013 | $0.36 | $0.42 | $0.44 | $0.53 | $1.75 | 10.1% |

| 2014 | $0.40 | $0.48 | $0.47 | $0.56 | $1.91 | 9.1% |

| 2015 | $0.46 | $0.56 | $0.53 | $0.60 | $2.15 | 12.6% |

| 2016 | $0.48 | $0.58 | $0.48 | $0.67 | $2.21 | 2.8% |

| 2017 | $0.56 | $0.60 | $0.60 | $0.64 | $2.40 | 8.6% |

| 2018 | $0.61 | $0.63 | $0.67 | $0.74 | $2.65 | 10.4% |

| 2019 | $0.65 | $0.62 | $0.79 | $0.78 | $2.84 | 7.2% |

| 2020 | $0.55 | $0.84 | $0.71 | $0.81 | $2.91 | 2.5% |

| 2021 | $0.66 | $0.75 | $0.75 | $0.94 | $3.10 | 6.5% |

| 2022 | $0.66 | $0.8479 | $0.7672 | $0.97 | $3.25 | 4.9% |

| 2023 | $0.7172 | $0.87670 | $0.7846 | $2.379 | -26.9% |

2011年から2022まで増配が続いている。

これがVYMの魅力!!

直近VYMの利回りは2.89%でした。(2023/9/15)

VYM構成銘柄と構成比率(2023年9月)

2023年9月の構成銘柄をすべて掲載しました。

VYMは年1回の入れ替えを行っており、個々の銘柄は確認して参考程度でお願いします。

2023年9月15日時点の構成銘柄です。

最新情報が気になる人はホームページで確認しよう。

| 順位 | 構成銘柄 | 構成比率 |

| 1 | JPMorgan Chase & Co. | 3.31% |

| 2 | Johnson & Johnson | 3.12% |

| 3 | Exxon Mobil Corporation | 3.12% |

| 4 | Procter & Gamble Company | 2.63% |

| 5 | Broadcom Inc. | 2.63% |

| 6 | Home Depot, Inc. | 2.42% |

| 7 | Chevron Corporation | 2.03% |

| 8 | Merck & Co., Inc. | 1.94% |

| 9 | AbbVie, Inc. | 1.89% |

| 10 | PepsiCo, Inc. | 1.85% |

| 11 | Coca-Cola Company | 1.73% |

| 12 | Walmart Inc. | 1.63% |

| 13 | Bank of America Corp | 1.60% |

| 14 | McDonald’s Corporation | 1.53% |

| 15 | Cisco Systems, Inc. | 1.53% |

| 16 | Pfizer Inc. | 1.46% |

| 17 | Comcast Corporation Class A | 1.34% |

| 18 | Wells Fargo & Company | 1.25% |

| 19 | Texas Instruments Incorporated | 1.17% |

| 20 | Philip Morris International Inc. | 1.11% |

| 21 | Intel Corporation | 1.07% |

| 22 | NextEra Energy, Inc. | 1.06% |

| 23 | QUALCOMM Incorporated | 1.06% |

| 24 | Verizon Communications Inc. | 1.03% |

| 25 | ConocoPhillips | 1.02% |

| 26 | Union Pacific Corporation | 1.01% |

| 27 | Caterpillar Inc. | 0.98% |

| 28 | United Parcel Service, Inc. Class B | 0.97% |

| 29 | Bristol-Myers Squibb Company | 0.94% |

| 30 | Honeywell International Inc. | 0.93% |

| 31 | RTX Corp. | 0.92% |

| 32 | Amgen Inc. | 0.90% |

| 33 | International Business Machines Corporation | 0.86% |

| 34 | Medtronic Plc | 0.83% |

| 35 | Goldman Sachs Group, Inc. | 0.82% |

| 36 | Starbucks Corporation | 0.82% |

| 37 | Morgan Stanley | 0.79% |

| 38 | BlackRock, Inc. | 0.79% |

| 39 | AT&T Inc. | 0.74% |

| 40 | Automatic Data Processing, Inc. | 0.73% |

| 41 | Lockheed Martin Corporation | 0.72% |

| 42 | Mondelez International, Inc. Class A | 0.72% |

| 43 | CVS Health Corporation | 0.68% |

| 44 | Gilead Sciences, Inc. | 0.68% |

| 45 | Citigroup Inc. | 0.66% |

| 46 | Chubb Limited | 0.60% |

| 47 | Schlumberger N.V. | 0.59% |

| 48 | Eaton Corp. Plc | 0.59% |

| 49 | Altria Group, Inc. | 0.58% |

| 50 | Illinois Tool Works Inc. | 0.57% |

| 51 | Southern Company | 0.56% |

| 52 | EOG Resources, Inc. | 0.56% |

| 53 | Blackstone Inc. | 0.53% |

| 54 | Progressive Corporation | 0.53% |

| 55 | Duke Energy Corporation | 0.52% |

| 56 | CME Group Inc. Class A | 0.51% |

| 57 | Air Products and Chemicals, Inc. | 0.48% |

| 58 | Waste Management, Inc. | 0.48% |

| 59 | Target Corporation | 0.45% |

| 60 | Colgate-Palmolive Company | 0.45% |

| 61 | 3M Company | 0.44% |

| 62 | U.S. Bancorp | 0.44% |

| 63 | Marathon Petroleum Corporation | 0.42% |

| 64 | General Dynamics Corporation | 0.39% |

| 65 | PNC Financial Services Group, Inc. | 0.39% |

| 66 | Emerson Electric Co. | 0.37% |

| 67 | Ford Motor Company | 0.37% |

| 68 | Phillips 66 | 0.37% |

| 69 | Johnson Controls International plc | 0.34% |

| 70 | Sempra | 0.34% |

| 71 | Valero Energy Corporation | 0.33% |

| 72 | Archer-Daniels-Midland Company | 0.33% |

| 73 | Dominion Energy Inc | 0.32% |

| 74 | American International Group, Inc. | 0.32% |

| 75 | PACCAR Inc | 0.32% |

| 76 | Truist Financial Corporation | 0.32% |

| 77 | General Mills, Inc. | 0.31% |

| 78 | American Electric Power Company, Inc. | 0.31% |

| 79 | Aflac Incorporated | 0.31% |

| 80 | Kimberly-Clark Corporation | 0.31% |

| 81 | Apollo Global Management Inc. | 0.30% |

| 82 | Williams Companies, Inc. | 0.30% |

| 83 | Exelon Corporation | 0.30% |

| 84 | MetLife, Inc. | 0.29% |

| 85 | Paychex, Inc. | 0.29% |

| 86 | Dow, Inc. | 0.29% |

| 87 | Travelers Companies, Inc. | 0.28% |

| 88 | Sysco Corporation | 0.28% |

| 89 | Cummins Inc. | 0.26% |

| 90 | Ameriprise Financial, Inc. | 0.26% |

| 91 | Baker Hughes Company Class A | 0.26% |

| 92 | L3Harris Technologies Inc | 0.26% |

| 93 | Bank of New York Mellon Corp | 0.26% |

| 94 | Fidelity National Information Services, Inc. | 0.26% |

| 95 | DuPont de Nemours, Inc. | 0.25% |

| 96 | Prudential Financial, Inc. | 0.25% |

| 97 | Kinder Morgan Inc Class P | 0.25% |

| 98 | Xcel Energy Inc. | 0.25% |

| 99 | Newmont Corporation | 0.24% |

| 100 | Hershey Company | 0.24% |

| 101 | MUTUAL FUND (OTHER) | 0.24% |

| 102 | Fastenal Company | 0.24% |

| 103 | Consolidated Edison, Inc. | 0.24% |

| 104 | Kroger Co. | 0.23% |

| 105 | Public Service Enterprise Group Inc | 0.22% |

| 106 | ONEOK, Inc. | 0.21% |

| 107 | Allstate Corporation | 0.21% |

| 108 | Kraft Heinz Company | 0.21% |

| 109 | HP Inc. | 0.20% |

| 110 | WEC Energy Group Inc | 0.20% |

| 111 | Edison International | 0.19% |

| 112 | T. Rowe Price Group | 0.19% |

| 113 | Discover Financial Services | 0.19% |

| 114 | Diamondback Energy, Inc. | 0.19% |

| 115 | Corning Inc | 0.18% |

| 116 | LyondellBasell Industries NV | 0.18% |

| 117 | Eversource Energy | 0.18% |

| 118 | State Street Corporation | 0.17% |

| 119 | Cardinal Health, Inc. | 0.17% |

| 120 | DTE Energy Company | 0.17% |

| 121 | M&T Bank Corporation | 0.17% |

| 122 | Baxter International Inc. | 0.16% |

| 123 | Ameren Corporation | 0.16% |

| 124 | Hartford Financial Services Group, Inc. | 0.16% |

| 125 | Genuine Parts Company | 0.16% |

| 126 | Entergy Corporation | 0.16% |

| 127 | International Flavors & Fragrances Inc. | 0.15% |

| 128 | Walgreens Boots Alliance, Inc. | 0.15% |

| 129 | FirstEnergy Corp. | 0.15% |

| 130 | Coterra Energy Inc. | 0.15% |

| 131 | Darden Restaurants, Inc. | 0.15% |

| 132 | PPL Corporation | 0.15% |

| 133 | Fifth Third Bancorp | 0.14% |

| 134 | Principal Financial Group, Inc. | 0.14% |

| 135 | Regions Financial Corporation | 0.14% |

| 136 | CenterPoint Energy, Inc. | 0.14% |

| 137 | Targa Resources Corp. | 0.13% |

| 138 | CMS Energy Corporation | 0.13% |

| 139 | Huntington Bancshares Incorporated | 0.13% |

| 140 | Atmos Energy Corporation | 0.13% |

| 141 | Kellogg Company | 0.12% |

| 142 | Reliance Steel & Aluminum Co. | 0.12% |

| 143 | Hubbell Incorporated | 0.12% |

| 144 | Omnicom Group Inc | 0.12% |

| 145 | NetApp, Inc. | 0.12% |

| 146 | Cincinnati Financial Corporation | 0.12% |

| 147 | Northern Trust Corporation | 0.12% |

| 148 | Garmin Ltd. | 0.12% |

| 149 | Bunge Limited | 0.12% |

| 150 | Best Buy Co., Inc. | 0.12% |

| 151 | CF Industries Holdings, Inc. | 0.11% |

| 152 | Ares Management Corporation | 0.11% |

| 153 | Conagra Brands, Inc. | 0.11% |

| 154 | Citizens Financial Group, Inc. | 0.11% |

| 155 | J.M. Smucker Company | 0.11% |

| 156 | Tyson Foods, Inc. Class A | 0.11% |

| 157 | Everest Group, Ltd. | 0.11% |

| 158 | Clorox Company | 0.11% |

| 159 | Stanley Black & Decker, Inc. | 0.11% |

| 160 | Synchrony Financial | 0.11% |

| 161 | AES Corporation | 0.10% |

| 162 | Snap-on Incorporated | 0.10% |

| 163 | Packaging Corporation of America | 0.10% |

| 164 | Alliant Energy Corp | 0.10% |

| 165 | Evergy, Inc. | 0.10% |

| 166 | Interpublic Group of Companies, Inc. | 0.09% |

| 167 | RPM International Inc. | 0.09% |

| 168 | Coca-Cola Europacific Partners plc | 0.09% |

| 169 | Viatris, Inc. | 0.09% |

| 170 | APA Corporation | 0.09% |

| 171 | Watsco, Inc. | 0.09% |

| 172 | International Paper Company | 0.09% |

| 173 | Celanese Corporation | 0.09% |

| 174 | Seagate Technology Holdings PLC | 0.09% |

| 175 | Molson Coors Beverage Company Class B | 0.09% |

| 176 | Hewlett Packard Enterprise Co. | 0.09% |

| 177 | Hormel Foods Corporation | 0.08% |

| 178 | Royalty Pharma Plc Class A | 0.08% |

| 179 | C.H. Robinson Worldwide, Inc. | 0.08% |

| 180 | NiSource Inc | 0.08% |

| 181 | KeyCorp | 0.08% |

| 182 | Gen Digital Inc. | 0.08% |

| 183 | Chesapeake Energy Corporation | 0.08% |

| 184 | Credicorp Ltd. | 0.08% |

| 185 | Vistra Corp. | 0.08% |

| 186 | Essential Utilities, Inc. | 0.07% |

| 187 | Equitable Holdings, Inc. | 0.07% |

| 188 | Tapestry, Inc. | 0.07% |

| 189 | Fidelity National Financial, Inc. – FNF Group | 0.07% |

| 190 | Eastman Chemical Company | 0.07% |

| 191 | New York Community Bancorp, Inc. | 0.07% |

| 192 | Unum Group | 0.07% |

| 193 | Pinnacle West Capital Corporation | 0.07% |

| 194 | Vail Resorts, Inc. | 0.07% |

| 195 | Reinsurance Group of America, Incorporated | 0.07% |

| 196 | Albertsons Companies, Inc. Class A | 0.06% |

| 197 | Williams-Sonoma, Inc. | 0.06% |

| 198 | Huntington Ingalls Industries, Inc. | 0.06% |

| 199 | Juniper Networks, Inc. | 0.06% |

| 200 | American Financial Group, Inc. | 0.06% |

| 201 | NRG Energy, Inc. | 0.06% |

| 202 | Campbell Soup Company | 0.06% |

| 203 | nVent Electric plc | 0.06% |

| 204 | East West Bancorp, Inc. | 0.06% |

| 205 | Autoliv Inc. | 0.06% |

| 206 | WestRock Company | 0.06% |

| 207 | Hasbro, Inc. | 0.06% |

| 208 | Franklin Resources, Inc. | 0.06% |

| 209 | Ally Financial Inc | 0.06% |

| 210 | Webster Financial Corporation | 0.06% |

| 211 | National Instruments Corporation | 0.06% |

| 212 | Whirlpool Corporation | 0.06% |

| 213 | Carlyle Group Inc | 0.05% |

| 214 | Old Republic International Corporation | 0.05% |

| 215 | Southern Copper Corporation | 0.05% |

| 216 | Jefferies Financial Group Inc. | 0.05% |

| 217 | HF Sinclair Corporation | 0.05% |

| 218 | Ingredion Incorporated | 0.05% |

| 219 | Polaris Inc. | 0.05% |

| 220 | First Horizon Corporation | 0.05% |

| 221 | OGE Energy Corp. | 0.05% |

| 222 | Assurant, Inc. | 0.05% |

| 223 | Comerica Incorporated | 0.05% |

| 224 | Paramount Global Class B | 0.05% |

| 225 | V.F. Corporation | 0.05% |

| 226 | Chord Energy Corporation | 0.05% |

| 227 | Cullen/Frost Bankers, Inc. | 0.05% |

| 228 | Murphy Oil Corporation | 0.05% |

| 229 | First American Financial Corporation | 0.05% |

| 230 | Invesco Ltd. | 0.04% |

| 231 | Oshkosh Corp | 0.04% |

| 232 | SouthState Corporation | 0.04% |

| 233 | Sonoco Products Company | 0.04% |

| 234 | UGI Corporation | 0.04% |

| 235 | Organon & Co. | 0.04% |

| 236 | Zions Bancorporation, N.A. | 0.04% |

| 237 | Prosperity Bancshares, Inc.(R) | 0.04% |

| 238 | Chemours Co. | 0.04% |

| 239 | RLI Corp. | 0.04% |

| 240 | Ralph Lauren Corporation Class A | 0.04% |

| 241 | Huntsman Corporation | 0.04% |

| 242 | DT Midstream, Inc. | 0.04% |

| 243 | IDACORP, Inc. | 0.04% |

| 244 | Civitas Resources, Inc. | 0.04% |

| 245 | H&R Block, Inc. | 0.04% |

| 246 | OneMain Holdings, Inc. | 0.04% |

| 247 | Popular, Inc. | 0.04% |

| 248 | Houlihan Lokey, Inc. Class A | 0.04% |

| 249 | Old National Bancorp | 0.04% |

| 250 | Perrigo Co. Plc | 0.04% |

| 251 | Flowserve Corporation | 0.04% |

| 252 | Synovus Financial Corp. | 0.03% |

| 253 | MGIC Investment Corporation | 0.03% |

| 254 | Bank OZK | 0.03% |

| 255 | Evercore Inc. Class A | 0.03% |

| 256 | Lincoln National Corp | 0.03% |

| 257 | National Fuel Gas Company | 0.03% |

| 258 | Ryder System, Inc. | 0.03% |

| 259 | MSC Industrial Direct Co., Inc. Class A | 0.03% |

| 260 | Flowers Foods, Inc. | 0.03% |

| 261 | Columbia Banking System, Inc. | 0.03% |

| 262 | Home BancShares, Inc. | 0.03% |

| 263 | Portland General Electric Company | 0.03% |

| 264 | F.N.B. Corporation | 0.03% |

| 265 | Triton International Ltd. Class A | 0.03% |

| 266 | Western Union Company | 0.03% |

| 267 | Cadence Bank | 0.03% |

| 268 | Equitrans Midstream Corporation | 0.03% |

| 269 | Crane Company | 0.03% |

| 270 | Macy’s, Inc. | 0.03% |

| 271 | Helmerich & Payne, Inc. | 0.03% |

| 272 | MDU Resources Group, Inc. | 0.03% |

| 273 | GATX Corporation | 0.03% |

| 274 | Advance Auto Parts, Inc. | 0.03% |

| 275 | Avnet, Inc. | 0.03% |

| 276 | Valley National Bancorp | 0.03% |

| 277 | United Bankshares, Inc. | 0.03% |

| 278 | New Jersey Resources Corporation | 0.03% |

| 279 | ONE Gas, Inc. | 0.03% |

| 280 | Axis Capital Holdings Limited | 0.03% |

| 281 | Hawaiian Electric Industries, Inc. | 0.03% |

| 282 | Newell Brands Inc | 0.03% |

| 283 | Radian Group Inc. | 0.03% |

| 284 | Antero Midstream Corp. | 0.03% |

| 285 | Southwest Gas Holdings, Inc. | 0.03% |

| 286 | Hanover Insurance Group, Inc. | 0.03% |

| 287 | Black Hills Corporation | 0.03% |

| 288 | ManpowerGroup Inc. | 0.03% |

| 289 | SLM Corp | 0.03% |

| 290 | Cabot Corporation | 0.03% |

| 291 | Janus Henderson Group PLC | 0.03% |

| 292 | Leggett & Platt, Incorporated | 0.03% |

| 293 | Lazard Ltd Class A | 0.03% |

| 294 | PNM Resources, Inc. | 0.03% |

| 295 | Hancock Whitney Corporation | 0.03% |

| 296 | TEGNA, Inc. | 0.03% |

| 297 | Wendy’s Company | 0.03% |

| 298 | Avient Corporation | 0.03% |

| 299 | International Game Technology PLC | 0.03% |

| 300 | Glacier Bancorp, Inc. | 0.03% |

| 301 | FirstCash Holdings, Inc. | 0.03% |

| 302 | NorthWestern Corporation | 0.02% |

| 303 | Assured Guaranty Ltd. | 0.02% |

| 304 | LCI Industries | 0.02% |

| 305 | United Community Banks, Inc. | 0.02% |

| 306 | Otter Tail Corporation | 0.02% |

| 307 | Sirius XM Holdings, Inc. | 0.02% |

| 308 | ALLETE, Inc. | 0.02% |

| 309 | Premier, Inc. Class A | 0.02% |

| 310 | Penske Automotive Group, Inc. | 0.02% |

| 311 | Moelis & Co. Class A | 0.02% |

| 312 | Spire Inc. | 0.02% |

| 313 | Kohl’s Corporation | 0.02% |

| 314 | Spectrum Brands Holdings, Inc. | 0.02% |

| 315 | Kemper Corp | 0.02% |

| 316 | ABM Industries Incorporated | 0.02% |

| 317 | Travel + Leisure Co. | 0.02% |

| 318 | M.D.C. Holdings, Inc. | 0.02% |

| 319 | Northern Oil and Gas, Inc. | 0.02% |

| 320 | CNO Financial Group, Inc. | 0.02% |

| 321 | Avista Corporation | 0.02% |

| 322 | MGE Energy, Inc. | 0.02% |

| 323 | Scotts Miracle-Gro Company Class A | 0.02% |

| 324 | Associated Banc-Corp | 0.02% |

| 325 | Walker & Dunlop, Inc. | 0.02% |

| 326 | Community Bank System, Inc. | 0.02% |

| 327 | Crane NXT, Co. | 0.02% |

| 328 | Patterson Companies Incorporated | 0.02% |

| 329 | Carpenter Technology Corporation | 0.02% |

| 330 | Carter’s, Inc. | 0.02% |

| 331 | Corebridge Financial, Inc. | 0.02% |

| 332 | Sensient Technologies Corporation | 0.02% |

| 333 | Nordstrom, Inc. | 0.02% |

| 334 | Jackson Financial Incorporation Class A | 0.02% |

| 335 | First Bancorp | 0.02% |

| 336 | Independent Bank Corp. | 0.02% |

| 337 | First Hawaiian, Inc. | 0.02% |

| 338 | Cathay General Bancorp | 0.02% |

| 339 | Avangrid, Inc. | 0.02% |

| 340 | Cogent Communications Holdings Inc | 0.02% |

| 341 | Artisan Partners Asset Management, Inc. Class A | 0.02% |

| 342 | Energizer Holdings, Inc. | 0.02% |

| 343 | Piper Sandler Companies | 0.02% |

| 344 | Simmons First National Corporation Class A | 0.02% |

| 345 | BOK Financial Corporation | 0.02% |

| 346 | CVB Financial Corp. | 0.02% |

| 347 | Steven Madden, Ltd. | 0.02% |

| 348 | Kennametal Inc. | 0.02% |

| 349 | Dana Incorporated | 0.02% |

| 350 | Atlantic Union Bankshares Corporation | 0.02% |

| 351 | Pacific Premier Bancorp, Inc. | 0.02% |

| 352 | First Interstate BancSystem, Inc. | 0.02% |

| 353 | Kontoor Brands, Inc. | 0.02% |

| 354 | Arch Resources, Inc. Class A | 0.02% |

| 355 | Bloomin’ Brands, Inc. | 0.02% |

| 356 | McGrath RentCorp | 0.02% |

| 357 | Worthington Industries, Inc. | 0.02% |

| 358 | Fulton Financial Corporation | 0.02% |

| 359 | BankUnited, Inc. | 0.02% |

| 360 | Bank of Hawaii Corp | 0.02% |

| 361 | Foot Locker, Inc. | 0.02% |

| 362 | Knife River Corporation | 0.02% |

| 363 | BancFirst Corporation | 0.02% |

| 364 | Clearway Energy, Inc. Class C | 0.02% |

| 365 | SJW Group | 0.02% |

| 366 | Eastern Bankshares, Inc. | 0.02% |

| 367 | First Financial Bancorp. | 0.02% |

| 368 | Jack in the Box Inc. | 0.01% |

| 369 | Cracker Barrel Old Country Store, Inc. | 0.01% |

| 370 | Gap, Inc. | 0.01% |

| 371 | Washington Federal, Inc. | 0.01% |

| 372 | Kennedy-Wilson Holdings, Inc. | 0.01% |

| 373 | First Merchants Corporation | 0.01% |

| 374 | Upbound Group, Inc. | 0.01% |

| 375 | Vector Group Ltd. | 0.01% |

| 376 | New Fortress Energy Inc. Class A | 0.01% |

| 377 | Greif Inc Class A | 0.01% |

| 378 | Delek US Holdings Inc | 0.01% |

| 379 | Xerox Holdings Corporation | 0.01% |

| 380 | Cheesecake Factory Incorporated | 0.01% |

| 381 | Navient Corp | 0.01% |

| 382 | Cal-Maine Foods, Inc. | 0.01% |

| 383 | TowneBank | 0.01% |

| 384 | Strategic Education, Inc. | 0.01% |

| 385 | Cohen & Steers, Inc. | 0.01% |

| 386 | Renasant Corporation | 0.01% |

| 387 | Virtu Financial, Inc. Class A | 0.01% |

| 388 | Atlantica Sustainable Infrastructure plc | 0.01% |

| 389 | Banner Corporation | 0.01% |

| 390 | Oxford Industries, Inc. | 0.01% |

| 391 | Bank of N.T. Butterfield & Son Limited (The) | 0.01% |

| 392 | Trustmark Corporation | 0.01% |

| 393 | Independent Bank Group, Inc. | 0.01% |

| 394 | WesBanco, Inc. | 0.01% |

| 395 | Park National Corporation | 0.01% |

| 396 | Archrock Inc. | 0.01% |

| 397 | Northwest Bancshares, Inc. | 0.01% |

| 398 | Northwest Natural Holding Co. | 0.01% |

| 399 | H&E Equipment Services, Inc. | 0.01% |

| 400 | NBT Bancorp Inc. | 0.01% |

| 401 | Tronox Holdings Plc | 0.01% |

| 402 | City Holding Company | 0.01% |

| 403 | Reynolds Consumer Products Inc | 0.01% |

| 404 | MillerKnoll, Inc. | 0.01% |

| 405 | First Commonwealth Financial Corporation | 0.01% |

| 406 | Tennant Company | 0.01% |

| 407 | Heartland Financial USA, Inc. | 0.01% |

| 408 | Greenbrier Companies, Inc. | 0.01% |

| 409 | John Wiley & Sons, Inc. Class A | 0.01% |

| 410 | Nu Skin Enterprises, Inc. Class A | 0.01% |

| 411 | Virtus Investment Partners, Inc. | 0.01% |

| 412 | La-Z-Boy Incorporated | 0.01% |

| 413 | Provident Financial Services, Inc. | 0.01% |

| 414 | ADT, Inc. | 0.01% |

| 415 | HNI Corporation | 0.01% |

| 416 | Stock Yards Bancorp, Inc. | 0.01% |

| 417 | Kaiser Aluminum Corporation | 0.01% |

| 418 | Westamerica Bancorporation | 0.01% |

| 419 | Hope Bancorp, Inc. | 0.01% |

| 420 | ZIM Integrated Shipping Services Ltd. | 0.01% |

| 421 | Horace Mann Educators Corporation | 0.01% |

| 422 | S&T Bancorp, Inc. | 0.01% |

| 423 | Universal Corp | 0.01% |

| 424 | SFL Corporation Limited | 0.01% |

| 425 | Medifast, Inc. | 0.01% |

| 426 | Apogee Enterprises, Inc. | 0.01% |

| 427 | Weis Markets, Inc. | 0.01% |

| 428 | CVR Energy, Inc. | 0.01% |

| 429 | PacWest Bancorp | 0.01% |

| 430 | Sandy Spring Bancorp, Inc. | 0.01% |

| 431 | Employers Holdings, Inc. | 0.01% |

| 432 | CNA Financial Corporation | 0.01% |

| 433 | Wolverine World Wide, Inc. | 0.01% |

| 434 | Berkshire Hills Bancorp, Inc. | 0.01% |

| 435 | Golden Ocean Group Ltd | 0.01% |

| 436 | Dine Brands Global, Inc. | 0.01% |

| 437 | WisdomTree, Inc. | 0.01% |

| 438 | Argo Group International Holdings, Ltd. | 0.01% |

| 439 | B&G Foods, Inc. | 0.01% |

| 440 | Healthcare Services Group, Inc. | 0.01% |

| 441 | Brookline Bancorp, Inc. | 0.01% |

| 442 | Star Bulk Carriers Corp. | 0.01% |

| 443 | Mercury General Corporation | 0.01% |

| 444 | Eagle Bancorp, Inc. | 0.01% |

| 445 | Mativ Holdings, Inc. | 0.01% |

| 446 | Capitol Federal Financial, Inc. | 0.01% |

| 447 | Clearway Energy, Inc. Class A | 0.01% |

| 448 | Telephone and Data Systems, Inc. | 0.01% |

| 449 | 1st Source Corporation | 0.01% |

| 450 | Steelcase Inc. Class A | 0.01% |

| 451 | TFS Financial Corporation | 0.01% |

| 452 | TTEC Holdings, Inc. | 0.00% |

| 453 | Kaman Corporation Class A | 0.00% |

| 454 | Trinseo PLC | 0.00% |

| 455 | Community Trust Bancorp, Inc. | 0.00% |

| 456 | Guess?, Inc. | 0.00% |

| 457 | Ardagh Metal Packaging S.A | 0.00% |

| 458 | Washington Trust Bancorp, Inc. | 0.00% |

| 459 | Kearny Financial Corp. | 0.00% |

| 460 | Sinclair, Inc. Class A | 0.00% |

| 461 | F&G Annuities & Life Inc | 0.00% |

| 462 | Enviva Inc | 0.00% |

| 463 | Republic Bancorp, Inc. Class A | 0.00% |

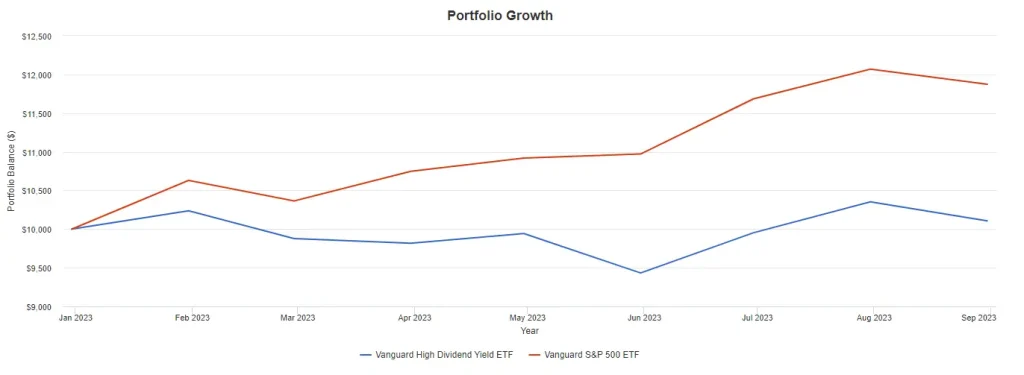

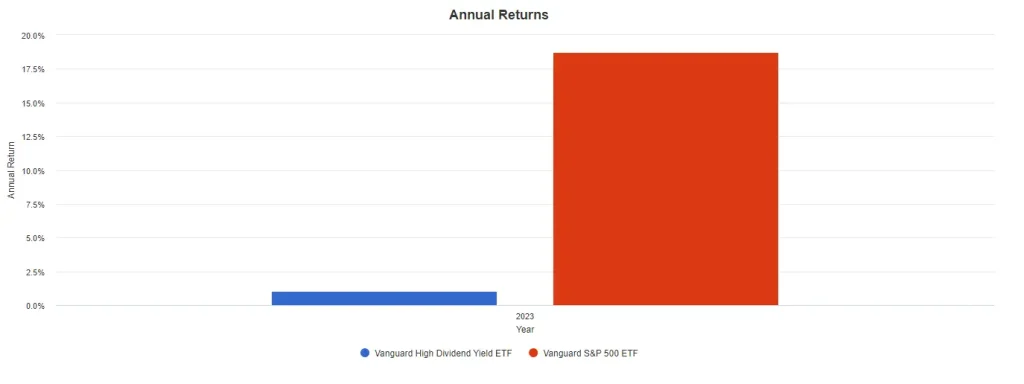

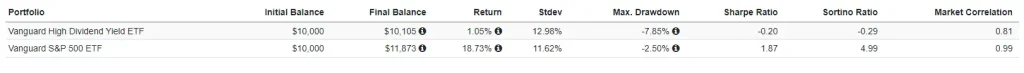

VYMとS&P500を比較 (2023年)

まとめ

・2023年Q3のVYMは前年同月比より6.74%増配。

・ただし2023年でVYMとVOOを比較するとVYMはトータルリターンにおいて劣勢を強いられている。

・投資家のインカムゲイン戦略は、現在の使える資産を増やすことはできるが、現実的にはインデックス投資と大きく離されている。

・資産形成期は高配当投資だけでなく、インデックス投資を行うべきでしょう。

証券会社を開設して株デビューするなら SBI証券!

雑談(サラリーマン投資家ぐりっと目線)

ぐりっと(総資産1,477万円)のVYM投資額は?

VYMは146株(非課税78株、NISA68株)投資しています。

非課税枠を売却して新NISAに移行する予定です。

コメント