本と投資は人を成長させるをコンセプトにしているブロガー、Youtuber、40代サラリーマン投資家ぐりっとです。

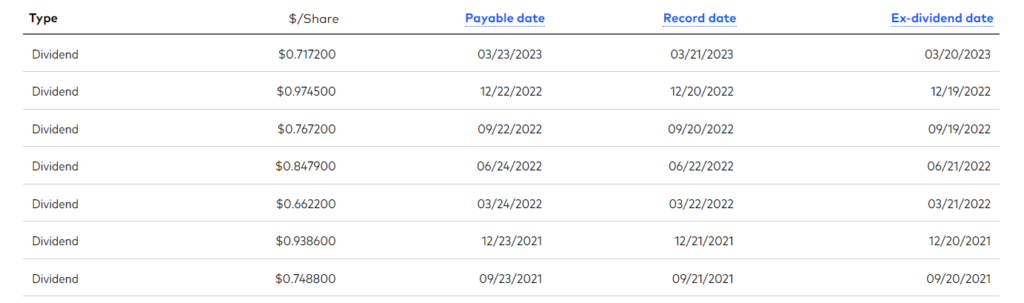

VYMの2023年Q1(3月)の配当が発表されました。

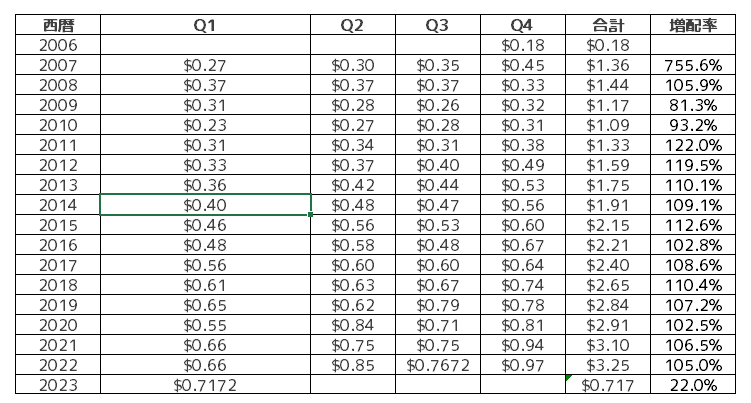

2023年Q1の配当は0.7172$。(ブログ内では0.72$と記載しています)

Q1の支払いは3月23日予定です。

2022年Q1は0.66ドルなので約8.31%増配です

増配率 = ((今回の配当 – 前回の配当) / 前回の配当) × 100%

今回の配当は0.7172$で、前回の配当は0.6622$

((0.7172 – 0.6622) / 0.6622) × 100% = 8.31%

参考サイト

VYMの投資成績を詳しく知りたい人はバンガード社のホームページを参考にしてください。

2023年Q1の成績一覧表 あわせて読みたい

ぐりっと

ぐりっとここからは2023年Q1をこれからも更新していきます。

VYM 基本知識

銘柄名:バンガード・米国高配当株式ETF

銘柄構成数:440(ブログの後半にすべて記載)

運用会社:バンガード社

設定日:2006年11月

経費率:年率0.06%

ベンチマーク:FTSEハイディビデンド・イールド・インデックス

VYM 株価・配当金・配当利回り

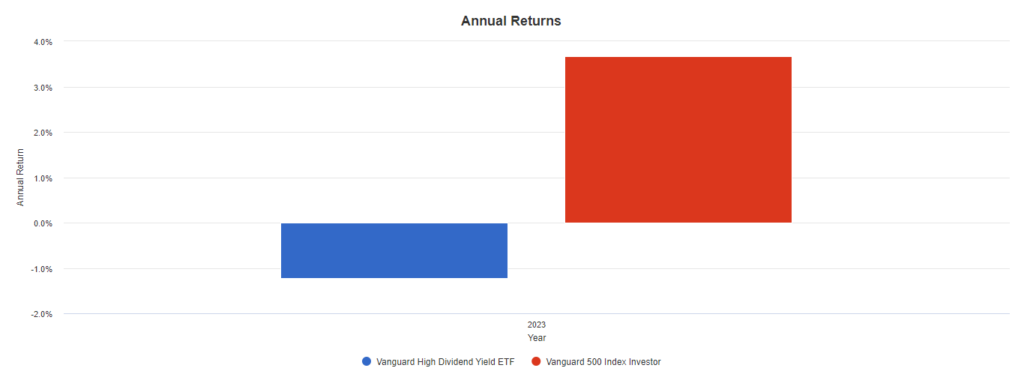

配当は増えていても、2023年は大きく値下がりしているね。

そうだね。

高配当銘柄がディフェンシブ銘柄が多いので

良く持ちこたえていると思うよ。

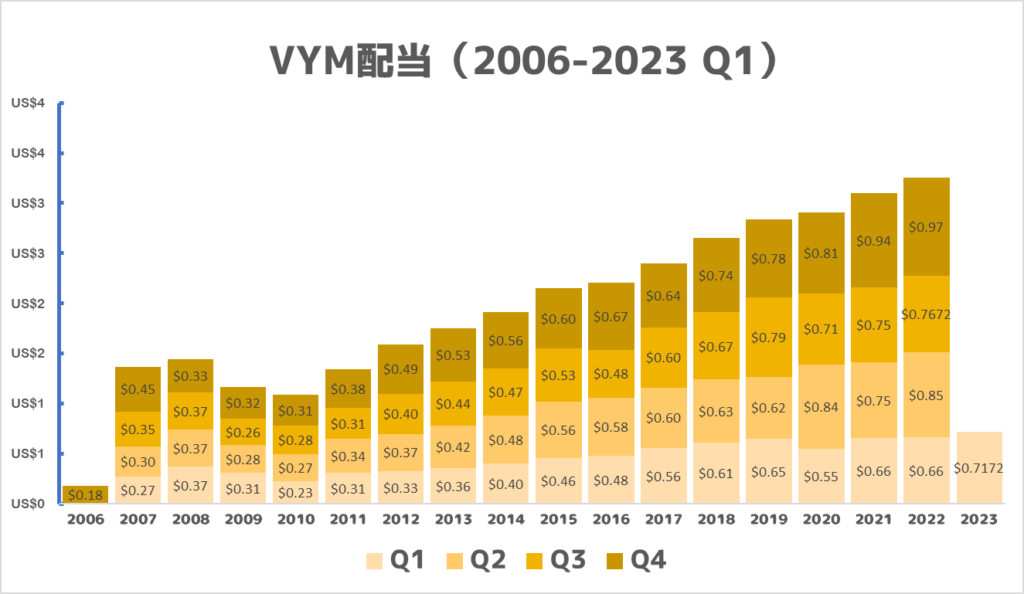

2010年から2022まで増配が続いている。

これがVYMの魅力!!

直近VYMの利回りは2.78%でした。(2023/3/17)

VYM構成銘柄と構成比率(2023年3月)

2023年3月の構成銘柄をすべて掲載しました。

VYMは年1回の入れ替えを行っており、個々の銘柄は個人で確認して参考程度でお願いします。

(投資は最終的に自己責任でお願いします。)

| 順位 | 構成銘柄 | 構成比率 |

|---|---|---|

| 1 | Exxon Mobil Corporation | 3.31% |

| 2 | Johnson & Johnson | 2.98% |

| 3 | JPMorgan Chase & Co. | 2.82% |

| 4 | Chevron Corporation | 2.33% |

| 5 | Procter & Gamble Company | 2.33% |

| 6 | Home Depot, Inc. | 2.32% |

| 7 | Eli Lilly and Company | 2.01% |

| 8 | Merck & Co., Inc. | 1.88% |

| 9 | AbbVie, Inc. | 1.81% |

| 10 | Pfizer Inc. | 1.73% |

| 11 | Bank of America Corp | 1.72% |

| 12 | Coca-Cola Company | 1.66% |

| 13 | PepsiCo, Inc. | 1.64% |

| 14 | Broadcom Inc. | 1.60% |

| 15 | Walmart Inc. | 1.42% |

| 16 | Cisco Systems, Inc. | 1.38% |

| 17 | McDonald’s Corporation | 1.37% |

| 18 | Wells Fargo & Company | 1.23% |

| 19 | Verizon Communications Inc. | 1.21% |

| 20 | Comcast Corporation Class A | 1.17% |

| 21 | Linde plc | 1.13% |

| 22 | Philip Morris International Inc. | 1.12% |

| 23 | Texas Instruments Incorporated | 1.11% |

| 24 | Bristol-Myers Squibb Company | 1.07% |

| 25 | ConocoPhillips | 1.05% |

| 26 | QUALCOMM Incorporated | 1.03% |

| 27 | NextEra Energy, Inc. | 1.03% |

| 28 | Raytheon Technologies Corporation | 1.02% |

| 29 | AT&T Inc. | 1.01% |

| 30 | Honeywell International Inc. | 0.97% |

| 31 | United Parcel Service, Inc. Class B | 0.94% |

| 32 | Amgen Inc. | 0.93% |

| 33 | Caterpillar Inc. | 0.91% |

| 34 | Starbucks Corporation | 0.87% |

| 35 | International Business Machines Corporation | 0.84% |

| 36 | Goldman Sachs Group, Inc. | 0.83% |

| 37 | Morgan Stanley | 0.83% |

| 38 | CVS Health Corporation | 0.80% |

| 39 | Intel Corporation | 0.80% |

| 40 | BlackRock, Inc. | 0.79% |

| 41 | Medtronic Plc | 0.77% |

| 42 | Lockheed Martin Corporation | 0.75% |

| 43 | Gilead Sciences, Inc. | 0.73% |

| 44 | Citigroup Inc. | 0.70% |

| 45 | Chubb Limited | 0.65% |

| 46 | Automatic Data Processing, Inc. | 0.65% |

| 47 | Mondelez International, Inc. Class A | 0.62% |

| 48 | Altria Group, Inc. | 0.56% |

| 49 | Schlumberger N.V. | 0.56% |

| 50 | Target Corporation | 0.55% |

| 51 | Progressive Corporation | 0.55% |

| 52 | Duke Energy Corporation | 0.55% |

| 53 | EOG Resources, Inc. | 0.53% |

| 54 | Southern Company | 0.51% |

| 55 | Illinois Tool Works Inc. | 0.50% |

| 56 | Air Products and Chemicals, Inc. | 0.49% |

| 57 | Blackstone Inc. | 0.46% |

| 58 | U.S. Bancorp | 0.46% |

| 59 | PNC Financial Services Group, Inc. | 0.46% |

| 60 | Truist Financial Corporation | 0.45% |

| 61 | Eaton Corp. Plc | 0.45% |

| 62 | 3M Company | 0.44% |

| 63 | CME Group Inc. Class A | 0.44% |

| 64 | Waste Management, Inc. | 0.44% |

| 65 | Colgate-Palmolive Company | 0.43% |

| 66 | Marathon Petroleum Corporation | 0.42% |

| 67 | General Dynamics Corporation | 0.39% |

| 68 | Valero Energy Corporation | 0.37% |

| 69 | Emerson Electric Co. | 0.37% |

| 70 | Ford Motor Company | 0.37% |

| 71 | Dominion Energy Inc | 0.37% |

| 72 | Sempra Energy | 0.35% |

| 73 | American Electric Power Company, Inc. | 0.33% |

| 74 | MetLife, Inc. | 0.33% |

| 75 | Johnson Controls International plc | 0.33% |

| 76 | Phillips 66 | 0.33% |

| 77 | American International Group, Inc. | 0.32% |

| 78 | General Mills, Inc. | 0.32% |

| 79 | Aflac Incorporated | 0.31% |

| 80 | Archer-Daniels-Midland Company | 0.31% |

| 81 | Travelers Companies, Inc. | 0.31% |

| 82 | Kimberly-Clark Corporation | 0.30% |

| 83 | Nucor Corporation | 0.30% |

| 84 | Newmont Corporation | 0.29% |

| 85 | Exelon Corporation | 0.29% |

| 86 | Dow, Inc. | 0.29% |

| 87 | Devon Energy Corporation | 0.28% |

| 88 | L3Harris Technologies Inc | 0.28% |

| 89 | Arthur J. Gallagher & Co. | 0.28% |

| 90 | Sysco Corporation | 0.27% |

| 91 | Williams Companies, Inc. | 0.27% |

| 92 | Prudential Financial, Inc. | 0.27% |

| 93 | Xcel Energy Inc. | 0.26% |

| 94 | Paychex, Inc. | 0.26% |

| 95 | PACCAR Inc | 0.26% |

| 96 | Ameriprise Financial, Inc. | 0.26% |

| 97 | Bank of New York Mellon Corp | 0.26% |

| 98 | DuPont de Nemours, Inc. | 0.26% |

| 99 | Kinder Morgan Inc Class P | 0.25% |

| 100 | Cummins Inc. | 0.24% |

| 101 | Apollo Global Management Inc. | 0.24% |

| 102 | Allstate Corporation | 0.23% |

| 103 | Consolidated Edison, Inc. | 0.23% |

| 104 | State Street Corporation | 0.23% |

| 105 | Hershey Company | 0.23% |

| 106 | Discover Financial Services | 0.22% |

| 107 | Public Service Enterprise Group Inc | 0.21% |

| 108 | ONEOK, Inc. | 0.21% |

| 109 | Baker Hughes Company Class A | 0.21% |

| 110 | WEC Energy Group Inc | 0.20% |

| 111 | HP Inc. | 0.20% |

| 112 | Kroger Co. | 0.20% |

| 113 | Fastenal Company | 0.20% |

| 114 | International Flavors & Fragrances Inc. | 0.20% |

| 115 | Kraft Heinz Company | 0.20% |

| 116 | Eversource Energy | 0.20% |

| 117 | M&T Bank Corporation | 0.19% |

| 118 | Walgreens Boots Alliance, Inc. | 0.18% |

| 119 | Corning Inc | 0.18% |

| 120 | Edison International | 0.18% |

| 121 | Diamondback Energy, Inc. | 0.18% |

| 122 | T. Rowe Price Group | 0.18% |

| 123 | LyondellBasell Industries NV | 0.17% |

| 124 | Fifth Third Bancorp | 0.17% |

| 125 | Hartford Financial Services Group, Inc. | 0.17% |

| 126 | FirstEnergy Corp. | 0.16% |

| 127 | Genuine Parts Company | 0.16% |

| 128 | DTE Energy Company | 0.15% |

| 129 | Principal Financial Group, Inc. | 0.15% |

| 130 | Ameren Corporation | 0.15% |

| 131 | Regions Financial Corporation | 0.15% |

| 132 | Entergy Corporation | 0.15% |

| 133 | PPL Corporation | 0.15% |

| 134 | Huntington Bancshares Incorporated | 0.15% |

| 135 | Citizens Financial Group, Inc. | 0.15% |

| 136 | Hewlett Packard Enterprise Co. | 0.14% |

| 137 | Cardinal Health, Inc. | 0.14% |

| 138 | Northern Trust Corporation | 0.14% |

| 139 | Steel Dynamics, Inc. | 0.14% |

| 140 | Coterra Energy Inc. | 0.14% |

| 141 | CenterPoint Energy, Inc. | 0.13% |

| 142 | Tyson Foods, Inc. Class A | 0.13% |

| 143 | AES Corporation | 0.13% |

| 144 | CMS Energy Corporation | 0.13% |

| 145 | Darden Restaurants, Inc. | 0.12% |

| 146 | Best Buy Co., Inc. | 0.12% |

| 147 | KeyCorp | 0.12% |

| 148 | Kellogg Company | 0.12% |

| 149 | Conagra Brands, Inc. | 0.12% |

| 150 | Omnicom Group Inc | 0.12% |

| 151 | Cincinnati Financial Corporation | 0.12% |

| 152 | CF Industries Holdings, Inc. | 0.11% |

| 153 | Synchrony Financial | 0.11% |

| 154 | Atmos Energy Corporation | 0.11% |

| 155 | J.M. Smucker Company | 0.11% |

| 156 | Garmin Ltd. | 0.11% |

| 157 | International Paper Company | 0.10% |

| 158 | Viatris, Inc. | 0.10% |

| 159 | Clorox Company | 0.10% |

| 160 | NetApp, Inc. | 0.10% |

| 161 | Interpublic Group of Companies, Inc. | 0.10% |

| 162 | Evergy, Inc. | 0.10% |

| 163 | Bunge Limited | 0.10% |

| 164 | Everest Re Group, Ltd. | 0.09% |

| 165 | Alliant Energy Corp | 0.09% |

| 166 | Celanese Corporation | 0.09% |

| 167 | Reliance Steel & Aluminum Co. | 0.09% |

| 168 | Seagate Technology Holdings PLC | 0.09% |

| 169 | Packaging Corporation of America | 0.09% |

| 170 | First Horizon Corporation | 0.09% |

| 171 | Hormel Foods Corporation | 0.09% |

| 172 | Snap-on Incorporated | 0.09% |

| 173 | U.S. Dollar | 0.09% |

| 174 | Gen Digital Inc. | 0.09% |

| 175 | Ares Management Corporation | 0.09% |

| 176 | Hubbell Incorporated | 0.08% |

| 177 | Equitable Holdings, Inc. | 0.08% |

| 178 | C.H. Robinson Worldwide, Inc. | 0.08% |

| 179 | Fidelity National Financial, Inc. – FNF Group | 0.08% |

| 180 | Coca-Cola Europacific Partners plc | 0.08% |

| 181 | RPM International Inc. | 0.08% |

| 182 | NiSource Inc | 0.08% |

| 183 | East West Bancorp, Inc. | 0.08% |

| 184 | Essential Utilities, Inc. | 0.08% |

| 185 | Tapestry, Inc. | 0.08% |

| 186 | V.F. Corporation | 0.08% |

| 187 | Eastman Chemical Company | 0.07% |

| 188 | Chesapeake Energy Corporation | 0.07% |

| 189 | Juniper Networks, Inc. | 0.07% |

| 190 | Paramount Global Class B | 0.07% |

| 191 | Reinsurance Group of America, Incorporated | 0.07% |

| 192 | Campbell Soup Company | 0.07% |

| 193 | WestRock Company | 0.07% |

| 194 | Ally Financial Inc | 0.07% |

| 195 | American Financial Group, Inc. | 0.07% |

| 196 | Comerica Incorporated | 0.07% |

| 197 | Watsco, Inc. | 0.07% |

| 198 | Credicorp Ltd. | 0.06% |

| 199 | Advance Auto Parts, Inc. | 0.06% |

| 200 | Molson Coors Beverage Company Class B | 0.06% |

| 201 | Vistra Corp. | 0.06% |

| 202 | Webster Financial Corporation | 0.06% |

| 203 | Williams-Sonoma, Inc. | 0.06% |

| 204 | Franklin Resources, Inc. | 0.06% |

| 205 | Huntington Ingalls Industries, Inc. | 0.06% |

| 206 | UGI Corporation | 0.06% |

| 207 | Whirlpool Corporation | 0.06% |

| 208 | Pinnacle West Capital Corporation | 0.06% |

| 209 | Unum Group | 0.06% |

| 210 | Olin Corporation | 0.06% |

| 211 | Autoliv Inc. | 0.06% |

| 212 | Jefferies Financial Group Inc. | 0.05% |

| 213 | NRG Energy, Inc. | 0.05% |

| 214 | Zions Bancorporation, N.A. | 0.05% |

| 215 | OGE Energy Corp. | 0.05% |

| 216 | Organon & Co. | 0.05% |

| 217 | Hasbro, Inc. | 0.05% |

| 218 | Cullen/Frost Bankers, Inc. | 0.05% |

| 219 | Carlyle Group Inc | 0.05% |

| 220 | Old Republic International Corporation | 0.05% |

| 221 | National Instruments Corporation | 0.05% |

| 222 | Assurant, Inc. | 0.05% |

| 223 | Invesco Ltd. | 0.05% |

| 224 | Ingredion Incorporated | 0.05% |

| 225 | Prosperity Bancshares, Inc.(R) | 0.05% |

| 226 | New York Community Bancorp, Inc. | 0.05% |

| 227 | nVent Electric plc | 0.05% |

| 228 | Commercial Metals Company | 0.04% |

| 229 | Southern Copper Corporation | 0.04% |

| 230 | Macy’s, Inc. | 0.04% |

| 231 | Polaris Inc. | 0.04% |

| 232 | Murphy Oil Corporation | 0.04% |

| 233 | First American Financial Corporation | 0.04% |

| 234 | MDU Resources Group Inc | 0.04% |

| 235 | Synovus Financial Corp. | 0.04% |

| 236 | Newell Brands Inc | 0.04% |

| 237 | H&R Block, Inc. | 0.04% |

| 238 | Lincoln National Corp | 0.04% |

| 239 | SouthState Corporation | 0.04% |

| 240 | Sonoco Products Company | 0.04% |

| 241 | Huntsman Corporation | 0.04% |

| 242 | Western Union Company | 0.04% |

| 243 | Crane Holdings, Co. | 0.04% |

| 244 | Chemours Co. | 0.04% |

| 245 | IDACORP, Inc. | 0.04% |

| 246 | United Bankshares, Inc. | 0.04% |

| 247 | DT Midstream, Inc. | 0.04% |

| 248 | Flowers Foods, Inc. | 0.04% |

| 249 | National Fuel Gas Company | 0.04% |

| 250 | Old National Bancorp | 0.04% |

| 251 | Bank OZK | 0.04% |

| 252 | RLI Corp. | 0.04% |

| 253 | Valley National Bancorp | 0.04% |

| 254 | Ralph Lauren Corporation Class A | 0.03% |

| 255 | Perrigo Co. Plc | 0.03% |

| 256 | F.N.B. Corporation | 0.03% |

| 257 | Timken Company | 0.03% |

| 258 | OneMain Holdings, Inc. | 0.03% |

| 259 | Glacier Bancorp, Inc. | 0.03% |

| 260 | Helmerich & Payne, Inc. | 0.03% |

| 261 | Axis Capital Holdings Limited | 0.03% |

| 262 | Houlihan Lokey, Inc. Class A | 0.03% |

| 263 | Popular, Inc. | 0.03% |

| 264 | Hanover Insurance Group, Inc. | 0.03% |

| 265 | New Jersey Resources Corporation | 0.03% |

| 266 | Leggett & Platt, Incorporated | 0.03% |

| 267 | Evercore Inc. Class A | 0.03% |

| 268 | Black Hills Corporation | 0.03% |

| 269 | Hawaiian Electric Industries, Inc. | 0.03% |

| 270 | Ryder System, Inc. | 0.03% |

| 271 | Flowserve Corporation | 0.03% |

| 272 | Southwest Gas Holdings, Inc. | 0.03% |

| 273 | Cadence Bank | 0.03% |

| 274 | Home BancShares, Inc. | 0.03% |

| 275 | Hancock Whitney Corporation | 0.03% |

| 276 | SLM Corp | 0.03% |

| 277 | South Jersey Industries, Inc. | 0.03% |

| 278 | TEGNA, Inc. | 0.03% |

| 279 | ONE Gas, Inc. | 0.03% |

| 280 | ManpowerGroup Inc. | 0.03% |

| 281 | Portland General Electric Company | 0.03% |

| 282 | Cabot Corporation | 0.03% |

| 283 | PNM Resources, Inc. | 0.03% |

| 284 | Avnet, Inc. | 0.03% |

| 285 | MGIC Investment Corporation | 0.03% |

| 286 | Triton International Ltd. Class A | 0.03% |

| 287 | Sirius XM Holdings, Inc. | 0.03% |

| 288 | GATX Corporation | 0.03% |

| 289 | Umpqua Holdings Corporation | 0.03% |

| 290 | Premier, Inc. Class A | 0.03% |

| 291 | Wendy’s Company | 0.03% |

| 292 | MSC Industrial Direct Co., Inc. Class A | 0.03% |

| 293 | Kohl’s Corporation | 0.03% |

| 294 | Avient Corporation | 0.03% |

| 295 | Kemper Corp | 0.03% |

| 296 | Antero Midstream Corp. | 0.03% |

| 297 | Spire Inc. | 0.03% |

| 298 | ALLETE, Inc. | 0.03% |

| 299 | Assured Guaranty Ltd. | 0.03% |

| 300 | Independent Bank Corp. | 0.02% |

| 301 | Janus Henderson Group PLC | 0.02% |

| 302 | First Hawaiian, Inc. | 0.02% |

| 303 | Foot Locker, Inc. | 0.02% |

| 304 | United Community Banks, Inc. | 0.02% |

| 305 | Radian Group Inc. | 0.02% |

| 306 | FirstCash Holdings, Inc. | 0.02% |

| 307 | Travel + Leisure Co. | 0.02% |

| 308 | Associated Banc-Corp | 0.02% |

| 309 | Lazard Ltd Class A | 0.02% |

| 310 | Jackson Financial Incorporation Class A | 0.02% |

| 311 | Penske Automotive Group, Inc. | 0.02% |

| 312 | NorthWestern Corporation | 0.02% |

| 313 | Sensient Technologies Corporation | 0.02% |

| 314 | CVB Financial Corp. | 0.02% |

| 315 | Cathay General Bancorp | 0.02% |

| 316 | PacWest Bancorp | 0.02% |

| 317 | ABM Industries Incorporated | 0.02% |

| 318 | Bank of Hawaii Corp | 0.02% |

| 319 | Community Bank System, Inc. | 0.02% |

| 320 | Pacific Premier Bancorp, Inc. | 0.02% |

| 321 | Avangrid, Inc. | 0.02% |

| 322 | Walker & Dunlop, Inc. | 0.02% |

| 323 | CNO Financial Group, Inc. | 0.02% |

| 324 | BankUnited, Inc. | 0.02% |

| 325 | Equitrans Midstream Corporation | 0.02% |

| 326 | Moelis & Co. Class A | 0.02% |

| 327 | Avista Corporation | 0.02% |

| 328 | BOK Financial Corporation | 0.02% |

| 329 | Cogent Communications Holdings Inc | 0.02% |

| 330 | Hanesbrands Inc. | 0.02% |

| 331 | Atlantic Union Bankshares Corporation | 0.02% |

| 332 | Scotts Miracle-Gro Company Class A | 0.02% |

| 333 | Clearway Energy, Inc. Class C | 0.02% |

| 334 | LCI Industries | 0.02% |

| 335 | Fulton Financial Corporation | 0.02% |

| 336 | Simmons First National Corporation Class A | 0.02% |

| 337 | Spectrum Brands Holdings, Inc. | 0.02% |

| 338 | Gap, Inc. | 0.02% |

| 339 | MGE Energy, Inc. | 0.02% |

| 340 | Kontoor Brands, Inc. | 0.02% |

| 341 | Otter Tail Corporation | 0.02% |

| 342 | Patterson Companies Incorporated | 0.02% |

| 343 | International Game Technology PLC | 0.02% |

| 344 | Cracker Barrel Old Country Store, Inc. | 0.02% |

| 345 | Columbia Banking System, Inc. | 0.02% |

| 346 | First Bancorp | 0.02% |

| 347 | Energizer Holdings, Inc. | 0.02% |

| 348 | First Merchants Corporation | 0.02% |

| 349 | First Financial Bancorp. | 0.02% |

| 350 | McGrath RentCorp | 0.02% |

| 351 | Dana Incorporated | 0.02% |

| 352 | Carpenter Technology Corporation | 0.02% |

| 353 | Kennametal Inc. | 0.02% |

| 354 | Washington Federal, Inc. | 0.02% |

| 355 | Banner Corporation | 0.02% |

| 356 | Scorpio Tankers Inc. | 0.02% |

| 357 | Independent Bank Group, Inc. | 0.02% |

| 358 | Artisan Partners Asset Management, Inc. Class A | 0.02% |

| 359 | WesBanco, Inc. | 0.01% |

| 360 | M.D.C. Holdings, Inc. | 0.01% |

| 361 | Nu Skin Enterprises, Inc. Class A | 0.01% |

| 362 | Strategic Education, Inc. | 0.01% |

| 363 | Kennedy-Wilson Holdings, Inc. | 0.01% |

| 364 | SJW Group | 0.01% |

| 365 | TowneBank | 0.01% |

| 366 | Heartland Financial USA, Inc. | 0.01% |

| 367 | Navient Corp | 0.01% |

| 368 | Tronox Holdings Plc | 0.01% |

| 369 | John Wiley & Sons, Inc. Class A | 0.01% |

| 370 | Renasant Corporation | 0.01% |

| 371 | Granite Construction Incorporated | 0.01% |

| 372 | Xerox Holdings Corporation | 0.01% |

| 373 | Vector Group Ltd. | 0.01% |

| 374 | Cohen & Steers, Inc. | 0.01% |

| 375 | ADT, Inc. | 0.01% |

| 376 | Virtu Financial, Inc. Class A | 0.01% |

| 377 | Trustmark Corporation | 0.01% |

| 378 | Worthington Industries, Inc. | 0.01% |

| 379 | Oxford Industries, Inc. | 0.01% |

| 380 | Greif Inc Class A | 0.01% |

| 381 | Northwest Natural Holding Co. | 0.01% |

| 382 | Atlantica Sustainable Infrastructure plc | 0.01% |

| 383 | Stock Yards Bancorp, Inc. | 0.01% |

| 384 | Northwest Bancshares, Inc. | 0.01% |

| 385 | Provident Financial Services, Inc. | 0.01% |

| 386 | BancFirst Corporation | 0.01% |

| 387 | NBT Bancorp Inc. | 0.01% |

| 388 | Reynolds Consumer Products Inc | 0.01% |

| 389 | H&E Equipment Services, Inc. | 0.01% |

| 390 | Jack in the Box Inc. | 0.01% |

| 391 | Bank of N.T. Butterfield & Son Limited (The) | 0.01% |

| 392 | ZIM Integrated Shipping Services Ltd. | 0.01% |

| 393 | Mativ Holdings, Inc. | 0.01% |

| 394 | Eagle Bancorp, Inc. | 0.01% |

| 395 | Virtus Investment Partners, Inc. | 0.01% |

| 396 | Hope Bancorp, Inc. | 0.01% |

| 397 | Horace Mann Educators Corporation | 0.01% |

| 398 | Sandy Spring Bancorp, Inc. | 0.01% |

| 399 | Westamerica Bancorporation | 0.01% |

| 400 | Weis Markets, Inc. | 0.01% |

| 401 | S&T Bancorp, Inc. | 0.01% |

| 402 | City Holding Company | 0.01% |

| 403 | First Commonwealth Financial Corporation | 0.01% |

| 404 | Kaiser Aluminum Corporation | 0.01% |

| 405 | Berkshire Hills Bancorp, Inc. | 0.01% |

| 406 | Telephone and Data Systems, Inc. | 0.01% |

| 407 | Upbound Group, Inc. | 0.01% |

| 408 | Archrock Inc. | 0.01% |

| 409 | Universal Corp | 0.01% |

| 410 | HNI Corporation | 0.01% |

| 411 | Wolverine World Wide, Inc. | 0.01% |

| 412 | La-Z-Boy Incorporated | 0.01% |

| 413 | Medifast, Inc. | 0.01% |

| 414 | Employers Holdings, Inc. | 0.01% |

| 415 | CNA Financial Corporation | 0.01% |

| 416 | SFL Corporation Limited | 0.01% |

| 417 | Dine Brands Global, Inc. | 0.01% |

| 418 | Brookline Bancorp, Inc. | 0.01% |

| 419 | Capitol Federal Financial, Inc. | 0.01% |

| 420 | Clearway Energy, Inc. Class A | 0.01% |

| 421 | Apogee Enterprises, Inc. | 0.01% |

| 422 | Atlas Corp. | 0.01% |

| 423 | Healthcare Services Group, Inc. | 0.01% |

| 424 | B&G Foods, Inc. | 0.01% |

| 425 | Greenbrier Companies, Inc. | 0.01% |

| 426 | Trinseo PLC | 0.01% |

| 427 | Mercury General Corporation | 0.01% |

| 428 | Argo Group International Holdings, Ltd. | 0.01% |

| 429 | Sinclair Broadcast Group, Inc. Class A | 0.01% |

| 430 | 1st Source Corporation | 0.01% |

| 431 | WisdomTree, Inc. | 0.01% |

| 432 | Washington Trust Bancorp, Inc. | 0.01% |

| 433 | TFS Financial Corporation | 0.00% |

| 434 | Guess?, Inc. | 0.00% |

| 435 | Community Trust Bancorp, Inc. | 0.00% |

| 436 | Steelcase Inc. Class A | 0.00% |

| 437 | Kearny Financial Corp. | 0.00% |

| 438 | Calavo Growers, Inc. | 0.00% |

| 439 | Big Lots, Inc. | 0.00% |

| 440 | Republic Bancorp, Inc. Class A | 0.00% |

| 441 | F&G Annuities & Life Inc | 0.00% |

| 442 | Vitesse Energy, Inc. | 0.00% |

2022年3月17日時点の構成銘柄です。

最新情報が気になる人はホームページで確認しよう。

どのくらい理解しておいたらいい?

すべての銘柄は覚える必要はないよ。

上位10銘柄21.79%、30銘柄で74.49%

上位30銘柄を抑えておこう。

非常に分散していることがよくわかるね

(よく計算したね・・・・)

VYMとS&P500を比較 (2023年Q1)

VYMは-1.23%、S&P500投資家は3.66%。

まとめ

・株価、配当は安定感がある、不況に強い

・高配当(インカムゲイン)狙いの人には非常におすすめのETFです

・キャピタルゲインを狙う人はインデックス投資信託やS&P500のETFの方をおすすめします

・投資手法によるが、高配当ETFは加える方が家計の安定性が高まる

雑談(サラリーマン投資家ぐりっと目線)

ぐりっと(総資産1,260万円)のVYM投資額は?

VYMは144株(非課税76株、NISA68株)、総資産/VYMは10-12%を投資しています。

今後も継続してVYMを購入予定です。

2023年3月27日にVYMの配当金が振り込まれていました。

税込みで12,161円でした。

株数が違うので比較できないけれど昨年度は7,445円。

63.26%増えていますね。

モチベーションを維持していこう。

関連記事:あわせて読みたい

コメント